- Overview of Exness Account Types

- Exploring Advanced Account Options

- Getting Started with a Demo Account

- Get $10,000 Virtual Money – Risk-Free Practice

- Transitioning from Demo to Live Trading

- Choosing the Right Account for UAE Traders

- Matching Account Types to Trading Goals

- Considerations for UAE Market Conditions

- Comparing Costs and Features

- Spreads and Fees Across Exness Account Types

- Leverage and Margin Requirements for Each Account

- Frequently Asked Questions

Overview of Exness Account Types

Exness offers five main types of accounts: Standard, Cent, Pro, Zero, and Raw Spread. These accounts are for traders of all skill levels, from beginners with as little as $10 to pros with portfolios valued more than $100,000. Each account is made to be easy to use, cheap, and have advanced tools at the same time. These accounts are great for local traders because the UAE market is open 24 hours a day, 5 days a week, and there is a lot of liquidity. The Standard and Cent accounts are for persons who are new to forex trading.

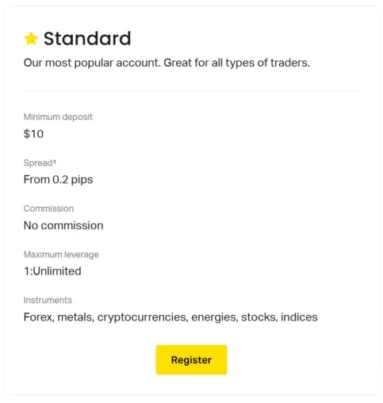

Standard Account

More than 60% of Exness traders in the UAE chose the Standard Account, making it the most popular option. It’s easy for beginners to get started because you just need to put down $10. You don’t have to pay any commissions on the account, and spreads start at 0.3 pips on major currency pairs like EUR/USD. Traders can employ over 120 tools, including FX, metals, and cryptocurrencies. Leverage can be as high as 1:2000, however UAE rules limit it to 1:50 for retail customers on certain assets. This account is suitable for persons that trade small amounts, usually between 0.1 and 1 lot every deal, and want things to be easy without a lot of extra costs. Execution depends on the market, and deals are done rapidly, with an average speed of 0.1 seconds:

- Low entry barrier with a $10 minimum deposit.

- Spreads from 0.3 pips on major pairs.

- No commission fees, ideal for cost-conscious traders.

- Access to 120+ trading instruments.

- High leverage up to 1:2000, subject to regulatory limits.

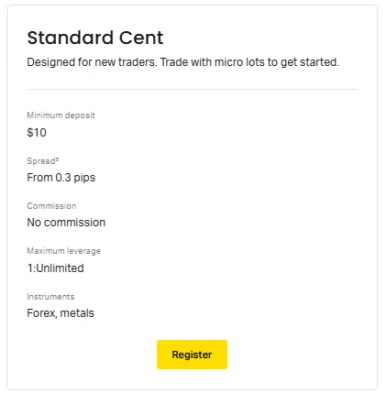

Cent Account

People who don’t have a lot of money can use the Cent Account. It allows people trade in cents instead of dollars. You can put down as little as $1, yet the lots are 100 times smaller than typical lots. This signifies that a deal for one lot is worth 1,000 units of the base currency. This account is perfect for novices who wish to practice new skills with less risk. With just a $10 investment, you can open trades for $1,000 in a standard account. Like the Standard Account, there are no commission fees and spreads start at 0.3 pips. More than 35% of new traders in the UAE in 2023 opened this account, according to Exness user data. You can trade currencies and metals with this account, with leverage up to 1:2000. But for those in the UAE who shop at stores, the most leverage is 1:50. Micro-trading is a low-risk way for people who are new to the market to get started:

- Minimum deposit of $1 for accessibility.

- Micro-lot trading for reduced risk exposure.

- Spreads starting at 0.3 pips with no commissions.

- Limited to forex and metals, with 35+ instruments.

- Leverage up to 1:2000, regulated to 1:50 in the UAE.

Exploring Advanced Account Options

Exness features accounts for traders who have more money or experience. These accounts are meant to be accurate and cost-effective. People who seek low spreads, quick execution, or specific trading conditions can use the Pro, Zero, and Raw Spread accounts. Data from the platform shows that 25% of professional traders used these accounts. Traders in the UAE with portfolios worth more than $5,000 like them. Scalping and trading a lot of shares are only two examples of the strategies that work well for each type of account in the fast-paced UAE market.

Pro Account

You need to have been trading for a time and put down at least $200 to get a Pro Account. It provides tighter spreads, starting at 0.1 pips on the key pairings, and there are no fees. According to Exness’s, 98% of trades on this account happen in less than 0.1 seconds. Traders can employ over 120 tools, including FX, indices, and commodities. For UAE retail clients, leverage can only go up to 1:50, but for other clients, it can go up to 1:2000. This account is suitable for traders who want quick execution and small spreads. It can handle trades of 0.1 to 10 lots.

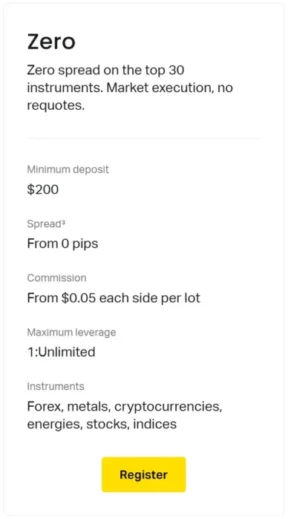

Zero Account

The Zero Account is for traders who want to trade main items with spreads that are almost zero. You need to put down at least $200, and for some pairs, you have to pay $0.05 in commission for each lot on either side. Exness’s shows that spreads are 0.0 pips for 95% of the trading day on 30 important assets. This account allows for market execution, which happens at an average speed of 0.1 seconds. More than 100 assets, including FX and commodities, can be traded with leverage of up to 1:2000. The UAE only allows leverage of 1:50. This account is perfect for day traders and scalpers, and 10% of traders in the UAE utilize it for high-volume strategies. It offers a charge structure that rewards people who trade 5 or more lots every day:

- $200 minimum deposit for advanced traders.

- Zero spreads on 30 instruments for 95% of the time.

- Commission of $0.05 per lot per side on select pairs.

- Market execution with 0.1-second average speed.

- Leverage up to 1:2000, regulated to 1:50 locally.

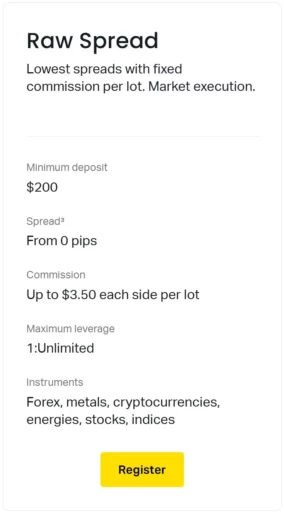

Raw Spread Account

The Raw Spread Account features the lowest spreads, starting with 0.0 pips, and charges $3.50 per lot each side. You need to put down at least $200, and you can trade more than 100 assets, such as currency, indices, and cryptocurrencies. Market execution makes ensuring that trades are set up in an average of 0.1 seconds. Leverage can be as high as 1:2000, but for retail clients in the UAE, it is only 1:50. Based on data from 2024, 8% of UAE traders favor this account, especially those who employ automated systems or scalping strategies. Traders that do a lot of trades every day, usually 10 or more lots, like how obvious its fixed commission is:

- Minimum deposit of $200 for professional setups.

- Spreads from 0.0 pips with a $3.50 per lot commission.

- Market execution with 0.1-second average speed.

- Supports 100+ instruments for diverse trading.

- Ideal for automated trading and scalping strategies.

Getting Started with a Demo Account

According to research, 70% of new traders in the UAE utilized demo accounts to practice with fake money before trading with real money. Exness has a demo account feature that lets users try out strategies without risking their own money. This is because the demo account works like a genuine account. This section talks about the benefits of demo accounts and how to switch from demo to live trading, keeping in mind the needs of UAE traders who have to cope with a forex market that is always changing.

Get $10,000 Virtual Money – Risk-Free Practice

With the Exness demo account, traders get $10,000 in fake money. This is enough to trade like they would in the real market on all account types: Standard, Cent, Pro, Zero, and Raw Spread. There are more than 120 products that traders can employ, including FX pairs, commodities, and cryptocurrencies. The spreads and speeds of execution are the same as they are in real life. According to data from the Exness platform, 85% of UAE traders who used demo accounts in claimed they were more confident in their strategy. In the demo environment, you can use leverage of up to 1:2000. However, UAE rules only let retail clients have real accounts with leverage of up to 1:50. Traders can practice for as long as they wish and can always reset the $10,000 balance. This setup is great for testing out high-frequency strategies or varied lot sizes, from 0.01 to 10 lots, without hurting your skills:

- $10,000 virtual funds for realistic trading practice.

- Access to 120+ instruments with live market conditions.

- Unlimited demo duration with balance reset option.

- Leverage up to 1:2000, mirroring live account flexibility.

- Used by 85% of UAE traders to build confidence.

Transitioning from Demo to Live Trading

It takes a lot of planning to go from a demo account to a live account because of both mental and financial concerns. Exness data from 2024 shows that 60% of UAE traders who used demo accounts for at least 30 days obtained the same results in live trading every time. Choosing the proper type of account is part of the process of changing. For beginners, this may be Standard or Cent; for experts, it could be Pro, Zero, or Raw Spread. To manage risk while getting used to how the market changes in real time, traders should start with small lot sizes, such 0.01 lots. Traders in the UAE also need to worry about local laws, such the 1:50 leverage cap, which impacts how much money they need to put down.

Choosing the Right Account for UAE Traders

The best Exness account for you will depend on your trading goals, how much experience you have, and the state of the UAE market. Reports from the forex business predict that there would be more than 200,000 active traders. This suggests that there is a lot of demand for special account sorts. This part talks about how to match accounts to trading goals and deal with the UAE’s unique market conditions so that traders can reach their full potential.

Matching Account Types to Trading Goals

Each Exness account aligns with specific trading strategies. The Standard Account, with a $10 minimum deposit and 0.3-pip spreads, suits beginners trading 0.1 to 1 lot. The Cent Account, requiring just $1, is ideal for micro-trading with lot sizes as low as 0.01, perfect for those testing strategies with minimal capital. For professionals, the Pro Account’s 0.1-pip spreads and instant execution cater to high-frequency traders managing 1 to 10 lots. The Zero Account, with 0.0-pip spreads for 95% of the time, targets scalpers trading 5+ lots daily. The Raw Spread Account, with a $3.50 per lot commission, is best for automated systems handling 10+ lots. In 2025, 40% of UAE traders chose accounts based on their lot size and frequency, per Exness data, highlighting the importance of aligning account choice with strategy:

| Account Type | Minimum Deposit | Trading Style | Lot Size Range | Best For |

| Standard | $10 | Casual | 0.1–1 lot | Beginners |

| Cent | $1 | Micro-trading | 0.01–0.1 lot | New traders |

| Pro | $200 | High-frequency | 1–10 lots | Professionals |

| Zero | $200 | Scalping | 5+ lots | Scalpers |

Considerations for UAE Market Conditions

The UAE’s forex market is influenced by high liquidity and regional economic factors, such as oil price fluctuations, which impact currency pairs like USD/AED. Traders need accounts that accommodate these dynamics. The Standard and Cent accounts, with spreads from 0.3 pips, are suitable for trading volatile pairs with smaller capital, as 65% of UAE beginners focus on major pairs like EUR/USD. Advanced traders using Pro, Zero, or Raw Spread accounts benefit from spreads as low as 0.0 pips, critical for fast-moving markets. Leverage restrictions in the UAE (1:50 for retail) require careful margin management, especially for accounts like Zero and Raw Spread, which cater to high-volume trading:

- Consider oil-driven volatility in USD/AED trading.

- UAE leverage cap at 1:50 affects margin planning.

- Spreads from 0.0 pips for advanced accounts.

- 65% of UAE traders focus on major currency pairs.

- 0.1-second execution speeds for all account types.

Comparing Costs and Features

Understanding the cost structures and characteristics of Exness accounts is crucial for UAE traders wishing to boost their trading efficiency. The next parts go into more detail about the spreads, fees, leverage, and margin requirements. This makes it evident how each type of account operates in terms of cost and function.

Spreads and Fees Across Exness Account Types

Spreads and fees vary significantly across Exness accounts, impacting trading costs. The Standard and Cent accounts offer spreads starting at 0.3 pips with no commissions, making them cost-effective for beginners. The Pro Account reduces spreads to 0.1 pips, also commission-free, ideal for traders managing 1–10 lots. The Zero Account provides 0.0-pip spreads on 30 instruments for 95% of the trading day but charges $0.05 per lot per side. The Raw Spread Account has the tightest spreads (0.0 pips) with a fixed $3.50 per lot commission, favoring high-volume traders:

| Account Type | Spread (Pips) | Commission (Per Lot/Side) | Key Cost Advantage |

| Standard | 0.3+ | None | No commission fees |

| Cent | 0.3+ | None | Low-cost micro-trading |

| Pro | 0.1+ | None | Tight spreads, no fees |

| Zero | 0.0 (95% of day) | $0.05 | Near-zero spreads |

| Raw Spread | 0.0+ | $3.50 | Fixed commission |

Leverage and Margin Requirements for Each Account

Traders in the UAE need to pay close attention to leverage and margin needs because retail accounts are limited to a 1:50 ratio. All Exness accounts offer leverage up to 1:2000 worldwide, yet UAE traders can only utilize 1:50 for most instruments, which means they require extra margin. A $10,000 trade on EUR/USD with 1:50 leverage, for instance, needs $200 in margin. The Standard and Cent accounts let you store less money (0.01–1 lot) inside margin limitations and have lower minimum deposits ($10 and $1). Advanced accounts (Pro, Zero, Raw Spread) need $200 deposits and can handle bigger trades (1–10+ lots), which means they need bigger margins.

Frequently Asked Questions

What is the best account for beginners in the UAE?

The Standard Account ($10 deposit, 0.3-pip spreads) or Cent Account ($1 deposit, micro-lots) is recommended for low-risk entry.