Types of Documents Traders Should Know

Traders engaging with Exness should be aware of several core legal documents. Each plays a unique role in shaping the relationship between the user and the platform:

- Client Agreement – The primary contract governing all interactions between the trader and the broker.

- Risk Disclosure Statement – Highlights the risks associated with trading derivatives such as CFDs.

- Privacy Policy – Outlines how Exness collects, stores, and protects personal data.

- General Business Terms – Supplementary terms that expand on conditions outlined in the main agreements.

- Regulatory Licenses and Compliance Statements – Documents showing how Exness meets financial regulatory standards across various jurisdictions.

- Complaints Handling Policy – Explains the process for resolving issues between clients and the company.

- Bonus/Credit Terms and Conditions – Rules related to promotional credits or bonus funds.

Each document is designed to protect both the trader and the broker, ensuring that operations are conducted fairly and according to defined procedures. It’s not necessary to memorize them, but it is important to know where to find them and understand their core principles.

Client Agreement Overview

The Client Agreement is the cornerstone of the trading relationship. It establishes the legal framework for account usage, order execution, fees, and dispute resolution. Every trader must agree to this document before opening a real account and starting to trade.

This agreement sets the tone for how the broker operates and what a trader can expect. It includes terms related to order processing, account suspension, leverage rules, and margin requirements. It also covers procedures for deposits and withdrawals, along with obligations regarding identification verification under anti-money laundering regulations.

Key Terms in the Client Agreement

A few terms in the Client Agreement carry more significance due to their direct impact on trading operations:

- Margin Call: When the equity in a trading account falls below required levels, the trader is expected to add funds or close positions.

- Stop Out: If the account balance continues to drop, the broker may forcibly close positions to prevent further losses.

- Negative Balance Protection: Ensures that traders cannot lose more than the balance in their account.

- Order Execution Policy: Describes how market and pending orders are handled, including potential slippage during volatile periods.

Understanding these concepts helps traders better manage risk and avoid unnecessary errors.

Trader Responsibilities

The agreement also outlines what is expected from the trader. These responsibilities go beyond placing trades:

- Keep login credentials confidential and secure.

- Maintain up-to-date identification documents.

- Avoid any trading activity that may be considered abusive or manipulative.

- Ensure that funds used for trading are legal and free from restrictions.

The document may also highlight that traders are responsible for monitoring their open positions and ensuring compliance with local regulations if applicable.

Risk Disclosure Information

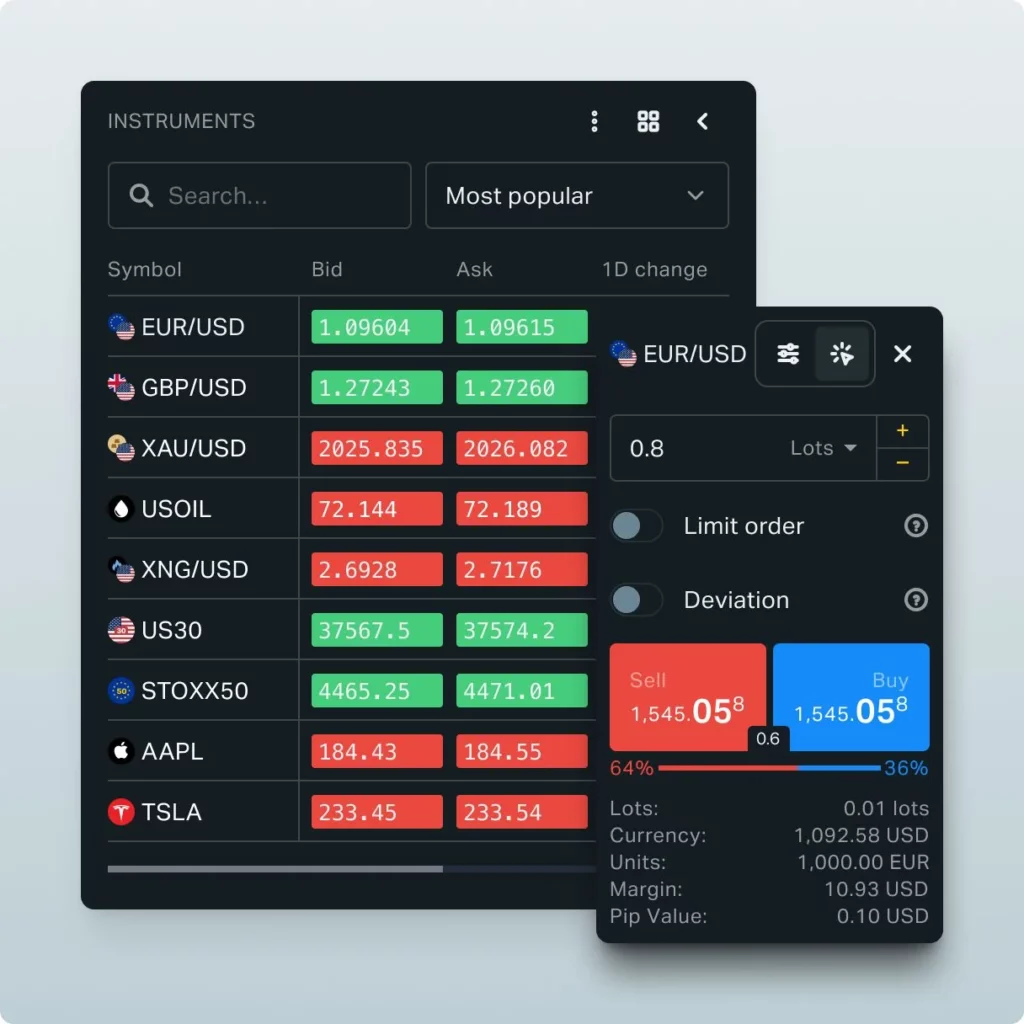

Contracts for Difference (CFDs) are leveraged instruments. While this can lead to gains, it also increases the likelihood of losses. Risk disclosure documentation is intended to ensure that traders are fully aware of the potential outcomes before they enter the market.

This document isn’t just a legal requirement. It acts as a reminder of the volatility inherent in financial markets. Traders are expected to read and accept the risk statement before trading begins. It is available on the broker’s website and usually sent via email upon account registration.

Understanding Trading Risks

The document outlines multiple categories of risk, each of which affects how trades perform and how capital is exposed:

- Leverage Risk: Trading with borrowed capital amplifies both gains and losses. A 2% move in the market can result in a 20% change in account equity when using high leverage.

- Market Volatility: Sudden news or economic shifts can lead to price gaps, where execution takes place at a worse rate than expected.

- Liquidity Risk: Some assets may not have enough trading volume during certain times, making it difficult to open or close positions.

- Technical Risk: Hardware or connectivity issues can disrupt order execution, especially during periods of high activity.

- Currency Risk: For accounts denominated in one currency and trading in another, exchange rate fluctuations can impact final results.

Traders are advised not to risk more than they can afford to lose and to implement safeguards such as stop loss orders and diversified positions.

How Risk Disclosures Protect Traders

The primary aim of this document is transparency. By clearly outlining what could go wrong, the broker helps users manage their expectations and encourages responsible trading behavior. It also serves as a legal foundation in case of disputes involving losses from price volatility or technical issues.

Some brokers go a step further by offering tools such as stop-out protection and negative balance protection. These safeguards are explained in the same disclosure and give traders a clearer view of what to expect under extreme market conditions.

It’s essential to treat this not as a disclaimer, but as a framework for making smarter trading decisions.

Privacy and Data Policies

In today’s trading environment, a trader’s data is as valuable as their capital. The privacy policy details how the broker collects, processes, and protects personal information. This includes anything from passport scans and bank account details to trading history and browser behavior.

Traders interact with the broker’s platform across multiple channels—desktop, mobile apps, email, and even live chat. Each interaction is subject to data capture, which is handled in accordance with regulatory requirements and internal security standards.

Data Handling Practices

The privacy policy outlines the types of data collected and how it is used:

- Personal identification: Names, birthdates, and national IDs are used to verify accounts and meet KYC requirements.

- Financial information: Bank details, deposit history, and payment methods are stored to facilitate account funding and withdrawals.

- Behavioral data: Device type, IP address, login patterns, and in-app usage are tracked to enhance security and platform functionality.

All this information is stored securely using encryption and access control protocols. Exness complies with international standards such as PCI DSS and applies data protection practices that limit internal access to authorized personnel only.

Data may also be shared with third parties in specific scenarios, such as fraud prevention services or legal authorities, but always under strict confidentiality rules.

Trader Rights Over Personal Data

The privacy policy grants users several important rights:

- Access: Traders can request a copy of all personal data stored by the broker.

- Correction: Errors in records can be corrected by contacting the broker through verified support channels.

- Deletion: Under certain conditions, clients can request the removal of their data once the business relationship ends.

- Restriction: Traders may limit the use of their data to specific functions, especially concerning marketing preferences.

- Withdrawal of Consent: Permission to use personal data can be withdrawn, although this may affect account services.

These provisions are aligned with global privacy laws such as GDPR. Users are encouraged to review their settings regularly and make adjustments based on their comfort level with data sharing.

Regulatory and Compliance Documents

A trading platform’s credibility often rests on its regulatory status. Regulatory and compliance documents help traders assess how well a broker aligns with industry rules, including how client funds are managed and how business operations are audited. These documents show the extent of a broker’s legal obligations and provide transparency into its relationship with governing authorities.

Exness holds regulatory licenses in multiple jurisdictions. While each license operates under the specific rules of its issuing body, the combined effect is a globally recognized compliance framework. Regulatory documents are typically available through official websites and often referenced in the Client Agreement or business disclosures.

Some of the key regulators associated with Exness include:

- Financial Services Authority (FSA) – Seychelles.

- Cyprus Securities and Exchange Commission (CySEC) – Cyprus.

- Financial Conduct Authority (FCA) – United Kingdom.

- Capital Markets Authority (CMA) – Kenya.

- Financial Sector Conduct Authority (FSCA) – South Africa.

- Financial Services Commission (FSC) – British Virgin Islands & Mauritius.

- Central Bank of Curaçao and Sint Maarten (CBCS).

Each license comes with its own set of operational requirements, such as capital reserves, transaction reporting, audit procedures, and client fund segregation.