This guide outlines the mechanics of margin trading, the tools available on Exness, and practical steps for calculating, managing, and optimizing trades using margin. Whether the aim is short-term speculation or portfolio diversification, understanding how margin works is critical to long-term sustainability in the market.

What is Margin Trading?

Margin trading is a form of leveraged investing that allows individuals to open positions larger than their account balance by borrowing funds from the broker. The amount needed to open and maintain a position—called the margin—is a percentage of the total trade value.

In essence, margin is the collateral required to cover potential losses. The use of leverage magnifies gains when the market moves in the trader’s favor, but it also increases losses when it moves against them.

Example: If a trader opens a $100,000 position on EUR/USD with 1:100 leverage, only $1,000 is required as margin. The remaining $99,000 is effectively borrowed. A 1% price move in the trade’s direction would result in a $1,000 profit (100% return on margin), but a 1% move against the trade would wipe out the entire margin.

Margin Trading on Exness

Margin trading on Exness is designed to accommodate both retail and professional traders. The platform provides access to a wide range of instruments with flexible leverage and detailed risk control mechanisms. Margin requirements vary depending on the asset, leverage used, and the size of the trade.

Available Instruments for Margin Trading

Exness offers margin trading across multiple asset classes via Contracts for Difference (CFDs). These include:

- Forex: Over 100 currency pairs including majors, minors, and exotics.

- Metals: Gold, silver, platinum, and palladium.

- Cryptocurrencies: Bitcoin, Ethereum, Litecoin, and others.

- Indices: Major indices such as NASDAQ, Dow Jones, FTSE 100.

- Energies: Crude oil (WTI, Brent), natural gas.

- Stocks: Shares from global companies across industries.

Each instrument class has specific trading conditions and margin requirements that affect trade sizing and exposure.

Leverage Options Offered

Leverage on Exness can be customized based on account type, instrument, and trading volume. Here are the typical maximum leverage ratios:

| Instrument | Maximum Leverage |

|---|---|

| Forex (Majors) | Up to 1:Unlimited |

| Metals | Up to 1:2000 |

| Indices | Up to 1:400 |

| Energies | Up to 1:200 |

| Cryptocurrencies | Up to 1:400 |

| Stocks | Up to 1:20 |

For professional accounts and high-volume traders, Exness offers special leverage tiers depending on total position size and account equity.

Margin Requirements by Asset Class

Margin requirements are defined by the formula:

Margin = (Trade Size × Contract Size × Market Price) / Leverage

Each asset class has different fixed or dynamic margin rules. Here’s an overview:

| Asset Class | Typical Margin Requirement | Execution Mode |

|---|---|---|

| Forex | From 0.5% (depending on leverage) | Market Execution |

| Metals | Varies by instrument and lot size | Market Execution |

| Cryptocurrencies | Generally higher due to volatility | Market Execution |

| Indices | Ranges from 1% to 5% | Market Execution |

| Energies | Typically between 1% to 3% | Market Execution |

| Stocks | Can exceed 5% | Market Execution |

Dynamic margin is applied in certain cases—especially with high trade volumes or on specific instruments—where the margin requirement increases with trade size.

How to Calculate Margin

Margin calculation is the foundation of effective risk management in leveraged trading. It helps traders understand how much capital is required to open and maintain a position.

The basic formula for margin is:

Margin = (Lot Size × Contract Size × Market Price) ÷ Leverage

Where:

- Lot Size is the number of lots being traded.

- Contract Size is the standard number of units per lot (e.g., 100,000 for Forex standard lot).

- Market Price is the current price of the instrument.

- Leverage is the multiplier applied to your capital.

Example Calculation: If a trader wants to open a 1-lot position on EUR/USD at a price of 1.2000 with 1:100 leverage:

Margin = (1 × 100,000 × 1.2000) ÷ 100

Margin = 120,000 ÷ 100 = 1,200 USD

This means $1,200 is required to open this position.

Using a Margin Calculator

To avoid manual calculations, Exness provides a margin calculator. This tool automatically computes the required margin for any instrument based on the desired lot size, account leverage, and current market prices.

Advantages of Using a Calculator:

- Saves time and reduces errors.

- Instantly adjusts results when leverage or lot size changes.

- Helps in planning trade size to align with account balance.

Traders can access the margin calculator directly on the platform or via the Exness website.

Managing Risks in Margin Trading

Using margin amplifies both profits and losses, making risk management essential. A disciplined approach ensures that market fluctuations do not lead to forced liquidation of positions.

Margin Calls and Stop-Out Levels

A margin call occurs when the equity in a trading account falls below a specified percentage of the used margin, requiring the trader to deposit additional funds or close positions.

- Margin Call Level: 60% on most Exness account types.

- Stop-Out Level: Positions are automatically closed when equity drops to 0% of the margin.

Strategies to Avoid Margin Issues

To maintain account health and avoid stop-outs, consider the following practices:

- Use Conservative Leverage: Avoid trading with the maximum available leverage unless you have strong risk controls in place.

- Set Stop Loss Orders: Limit potential losses by predetermining exit levels.

- Monitor Equity Regularly: Track margin usage, free margin, and account equity closely.

- Diversify Positions: Spread exposure across multiple instruments to reduce risk concentration.

- Avoid Overtrading: Opening too many positions simultaneously increases margin utilization and risk.

Tip: Use the “Stop Out Protection” feature on Exness to help avoid sudden stop-outs during volatile conditions.

Getting Started with Margin Trading

Starting margin trading on Exness is straightforward and suitable for traders with varying levels of experience.

Step-by-Step Process:

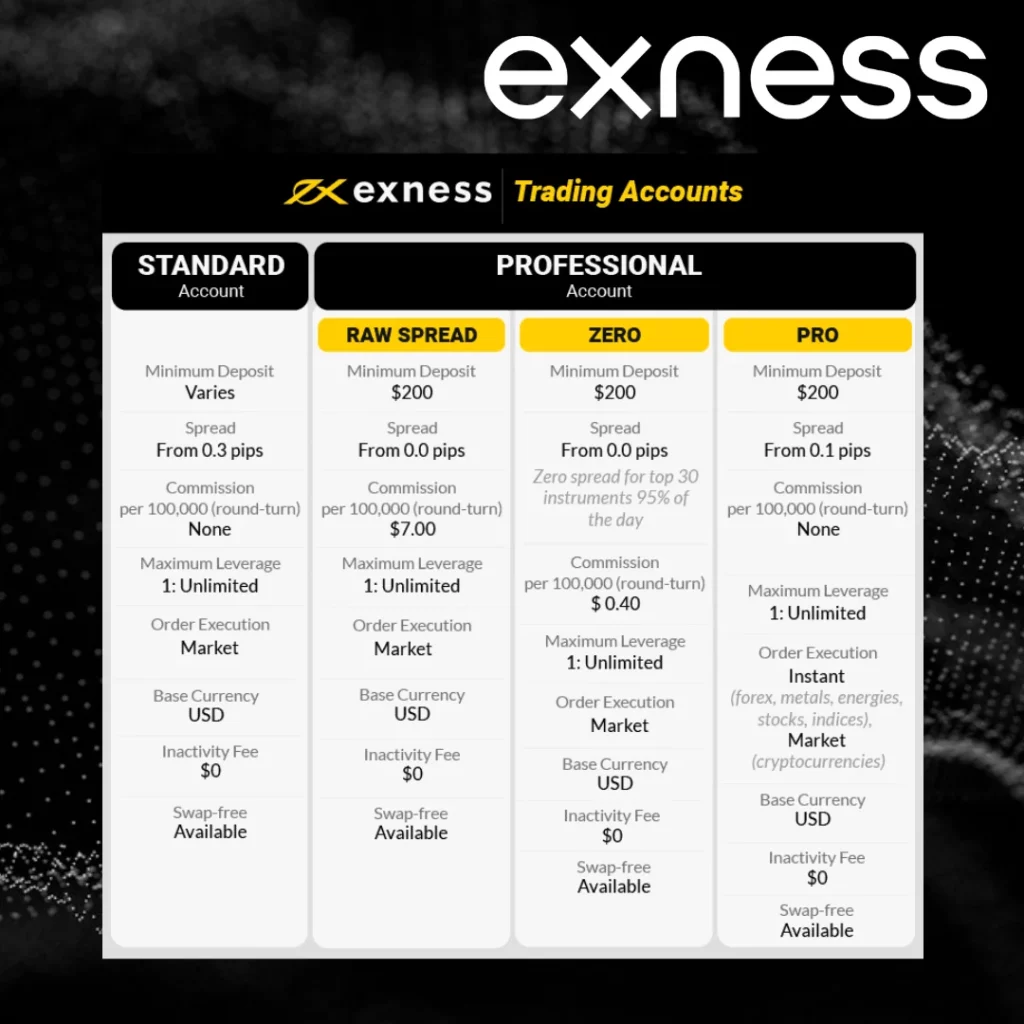

- Open an Account: Choose from account types like Standard, Pro, Raw Spread, or Zero, based on trading style and experience.

- Fund Your Account: Use local or international payment methods. Deposits are instant in most cases.

- Select Leverage: Set a leverage ratio appropriate to your risk profile.

- Choose an Instrument: Access Forex, metals, cryptocurrencies, indices, stocks, and energies.

- Open a Trade: Define position size, set stop loss and take profit levels, and monitor margin usage.

- Manage the Trade: Adjust stop levels or close positions as market conditions evolve.

Minimum Deposit and Leverage Options by Account Type:

| Account Type | Minimum Deposit | Maximum Leverage |

| Standard Cent | $10 | Up to 1:Unlimited |

| Standard | $10 | Up to 1:Unlimited |

| Pro | $200 | Up to 1:2000 |

| Raw Spread | $200 | Up to 1:2000 |

| Zero | $200 | Up to 1:2000 |

Frequently Asked Questions

What is the minimum margin required to open a trade on Exness?

The minimum margin depends on the instrument, account type, and leverage. For example, with 1:100 leverage on a Standard account, a position worth $100,000 in EUR/USD would require just $1,000 as margin. Exness also offers “unlimited leverage” under specific conditions for experienced traders.