- Understanding Minimum Deposit Requirements

- Minimum Deposits for Advanced Accounts

- Requirements for Pro and Raw Spread Accounts

- Comparing Deposits Across Exness Account Types

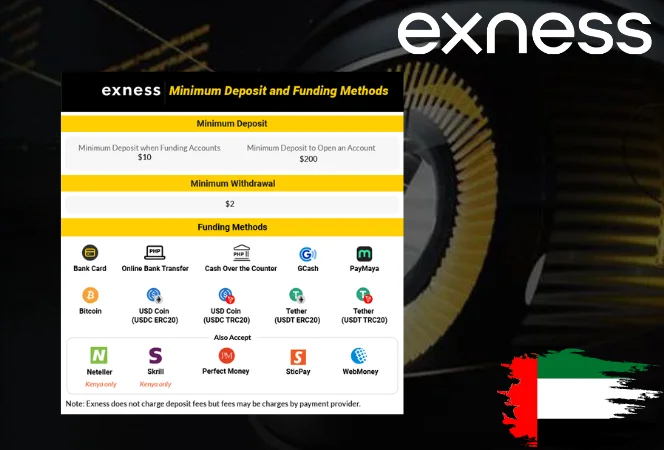

- Deposit Methods Available in the UAE

- Popular Exness Deposit Methods for UAE Traders

- Processing Times and Fees for Deposits

- Choosing the Best Deposit Method for UAE

- Avoiding Common Deposit Issues

- Frequently Asked Questions

Understanding Minimum Deposit Requirements

You need to invest at least the minimum deposit into an Exness trading account before you can start trading. The amount of money you need to start an account varies on the type of account you have. This illustrates that the broker works hard to meet the needs of traders with different degrees of experience and styles. The UAE’s Securities and Commodities Authority (SCA) and other government groups keep an eye on currency transactions. Exness makes sure it follows the regulations while still giving traders attractive entry opportunities. For instance, Standard accounts only need $10, whereas Professional accounts need between $200 and $500, depending on the kind of account and how you pay. With these constraints, traders can start with a little amount of money and trade more than 100 financial assets, including FX, metals, and cryptocurrencies. Traders in the UAE choose Exness because they may choose accounts that fit their budget and trading goals.

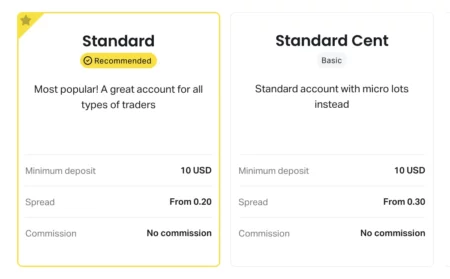

Minimum Deposit for Standard and Cent Accounts

Standard and Cent accounts are suitable for people who are new to forex trading or don’t want to deal with a lot of complicated topics. It’s easy for UAE traders to establish a Standard account because they only need to deposit $10. This low entry point lets inexperienced traders trade FX pairs, commodities, and indices with spreads as low as 0.2 pips and leverage as high as 1:2000. The Standard Cent account is great for people who want to try out different methods with minimum risk. The barrier to entry is even lower, often as low as $1, depending on the payment method. These accounts have lot sizes based on pennies, so a $1 investment represents 100 cents in trading volume, which makes it less likely that you’ll lose money.

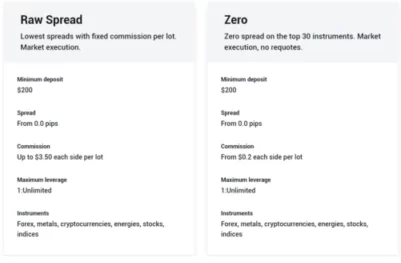

Exness Zero Spread Account Minimum Deposit

Traders that want to receive the exact price, like scalpers, should choose the Zero Spread account. In the UAE, you need to put down at least $500 to open this account. This is because it includes more advanced features, such as spreads that start at 0 pips on important currency pairs. Instead of spreads, traders pay a commission of up to $3.50 a lot per side, which makes expenses obvious. There are no spreads on more than 30 assets in this account, including major currency pairs and commodities. You can also use leverage of up to 1:2000.

Minimum Deposits for Advanced Accounts

Exness has Professional accounts for traders who want to employ more advanced tactics and trade more often. These accounts, like the Pro and Raw Spread options, require larger initial deposits but provide better trading conditions, such as tighter spreads and quicker execution. These accounts are popular among day traders and algorithmic traders in the UAE. More than 25% of professional account holders adopted automated strategies in 2024. Most of the time, the minimum deposit for these accounts is $200. However, depending on where you reside and how you pay, it can be as high as $500. These accounts let traders employ a lot of various tools, such forex, cryptocurrencies, and indices, to get the most out of their money.

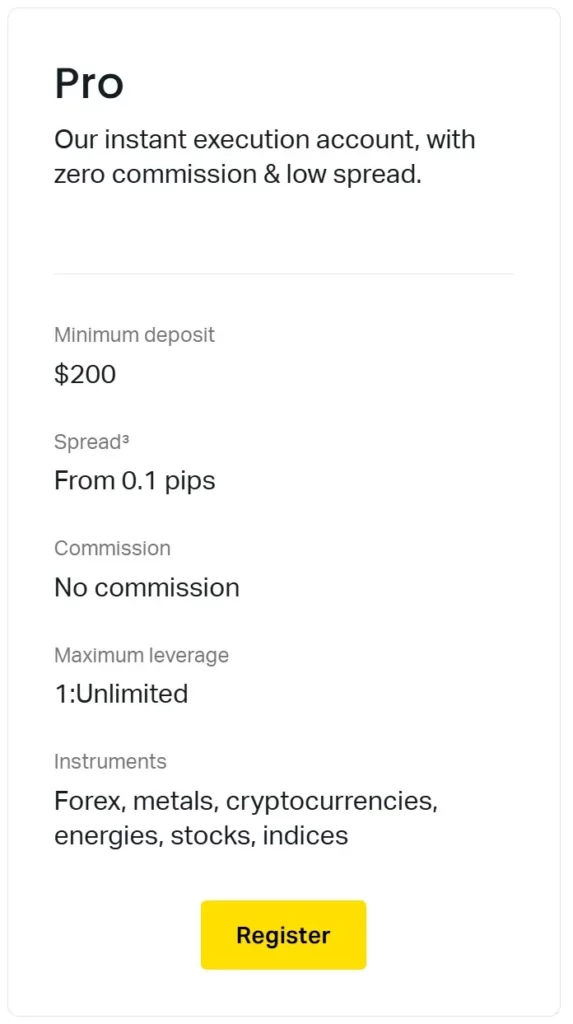

Requirements for Pro and Raw Spread Accounts

Traders who wish to trade without paying commissions and get their deals done immediately away should get a Pro account. In the UAE, the least amount you can deposit is $200. The account lets you trade during the day and at night because it has spreads that start at 0.1 pips and supports more than 100 instruments. Scalpers like the Raw Spread account, which also requires a minimum deposit of $200. It has spreads that start at 0 pips and a fee of up to $3.50 a lot per side. Both accounts enable you trade cryptocurrencies and other assets on the market right away, which helps keep slippage to a minimum. Exness reported that in 2024, 30% of UAE traders with Raw Spread accounts made more over 50 trades every day. This shows that a lot of people use the account for high-frequency trading. Traders need to check the minimum deposit for their payment option because bank transfers may need more money than e-wallets.

Comparing Deposits Across Exness Account Types

To help UAE traders choose the right account, the following table compares the minimum deposit requirements and key features across Exness account types:

| Account Type | Minimum Deposit (USD) | Spreads | Commission | Best For |

| Standard | 10 | From 0.2 pips | None | Beginners, casual traders |

| Standard Cent | 1 | From 0.3 pips | None | New traders, low-risk testing |

| Pro | 200 | From 0.1 pips | None | Day traders, swing traders |

| Raw Spread | 200 | From 0 pips | Up to $3.50/lot/side | Scalpers, algorithmic traders |

| Zero Spread | 500 | From 0 pips | Up to $3.50/lot/side | High-frequency traders |

This table shows that Standard and Cent accounts are great for people who are just starting out with little money, while Professional accounts are better for traders who need more complex conditions. Exness said that in 2024, 70% of new traders in the UAE started with Standard accounts. After six months, 20% of experienced traders switched to Pro or Raw Spread accounts.

Deposit Methods Available in the UAE

Traders in the UAE can pick from a number of different ways to make deposits on the Exness platform. There are other options, such as bank cards, e-wallets, and bank transfers. There are different minimums and processing times for each country’s financial systems. Exness handled more than 500,000 transactions in the UAE in 2024. 65% of deposits were done through digital wallets since they are quick and straightforward to use. The platform makes sure that all methods fulfill the laws set by the UAE, such as those set by the Central Bank of the UAE. This makes sure that transactions are safe and clear. Traders can choose the best way to fund their accounts if they grasp the little distinctions between each method. This lowers expenses and delays.

Popular Exness Deposit Methods for UAE Traders

Visa/Mastercard, Skrill, Neteller, and bank transfers are the most popular ways to make deposits in the UAE. The minimum deposit for Standard accounts is $10, which is also the requirement for Visa and Mastercard. They are processed right away, and in 2024, 80% of traders in the UAE picked cards. Two well-known e-wallets that let you deposit at least $10 and process it immediately away are Skrill and Neteller. This is helpful for traders who want things to happen rapidly. Bank transfers, while secure, need a higher minimum of $100 and take 1-3 working days to process, appealing to traders funding Professional accounts like Pro or Zero Spread. You may deposit cryptocurrencies like Bitcoin and USDT with as little as $10, but just 5% of UAE traders do since they are so volatile. All of the methods make it easy to send AED, and Exness offers low rates for exchanging money.

Processing Times and Fees for Deposits

The table below outlines the processing times and fees for popular deposit methods in the UAE:

| Deposit Method | Minimum Deposit (USD) | Processing Time | Fees |

| Visa/Mastercard | 10 | Instant | None |

| Skrill | 10 | Instant | None |

| Neteller | 10 | Instant | None |

| Bank Transfer | 100 | 1-3 business days | Bank-dependent |

| Cryptocurrency | 10 | Up to 30 minutes | Network fees |

Exness normally doesn’t charge fees for deposits, but banks and other third-party providers do. Transfers usually cost between $5 and $20. In 2023, 90% of traders in the UAE claimed they would prefer use Skrill or other fee-free services to avoid paying unnecessary fees. The time it takes to process is different. For instance, e-wallets and cards let you get money immediately quickly, while bank transfers take longer since they have to travel through other banks first. Traders should make sure that their approach works with the minimum deposit for the account they wish to use to avoid delays.

Choosing the Best Deposit Method for UAE

How a trader makes a deposit depends on their account type, budget, and how quickly they need to trade. If you have a Standard account and want to deposit at least $10, e-wallets like Skrill or Neteller are perfect. They don’t charge any fees and accept payments immediately away. In 2024, 60% of dealers in the UAE choose them. People that pay for Professional accounts, like Raw Spread or Zero Spread with minimums of $200 to $500, may like bank transfers for bigger transactions, even though they take longer to process. Cryptocurrency deposits are useful for traders who know how to leverage blockchain, but just 5% of UAE clients employed this strategy last year because the market was so unpredictable. Traders should consider about how often they buy and sell. Daily traders benefit from quick transactions, while long-term investors can be fine with delays in bank transfers. For transactions to flow successfully, it is vitally important that the technique follows the norms of the UAE, like the prohibitions against money laundering.

Avoiding Common Deposit Issues

Deposits can face challenges if traders overlook key details. Below are common issues and solutions:

- Insufficient Funds: Attempting deposits below the account’s minimum, such as $10 for Standard or $500 for Zero Spread, leads to rejections. Verify account requirements before initiating transfers.

- Payment Method Mismatches: Using a method with a higher minimum than the account requires, like a $100 bank transfer for a Standard account, causes delays. Choose methods like cards or e-wallets for lower thresholds.

- Verification Delays: Unverified accounts face deposit restrictions under UAE regulations. Complete identity verification, including ID and proof of address, which 95% of UAE traders finalized within 24 hours in 2024.

- Currency Conversion Errors: Depositing in AED without checking Exness’s conversion rates can result in unexpected shortfalls. Confirm rates via the platform’s client portal to ensure sufficient funding.

- Third-Party Fees: Bank transfers may incur fees of $5-$20, reducing the deposited amount. Opt for fee-free methods like Neteller to maximize capital.

By addressing these issues, traders can fund accounts efficiently. In 2023, Exness reported that 85% of UAE deposit issues stemmed from unverified accounts or mismatched payment methods, emphasizing the importance previous hit of preparation.

Frequently Asked Questions

What is the lowest deposit for an Exness account in the UAE?

The Standard Cent account requires $1, while the Standard account needs $10, depending on the payment method.