Overview of Pro and Zero Spread Accounts

The Pro and Zero Spread accounts serve different purposes in the broader strategy of active trading. A Pro account typically appeals to those who value simplicity — minimal fees, consistent execution, and reliable spreads. On the other hand, Zero Spread accounts are built for precision. These accounts are ideal when the goal is to trade at the exact quoted price, particularly around news releases or during periods of high volatility.

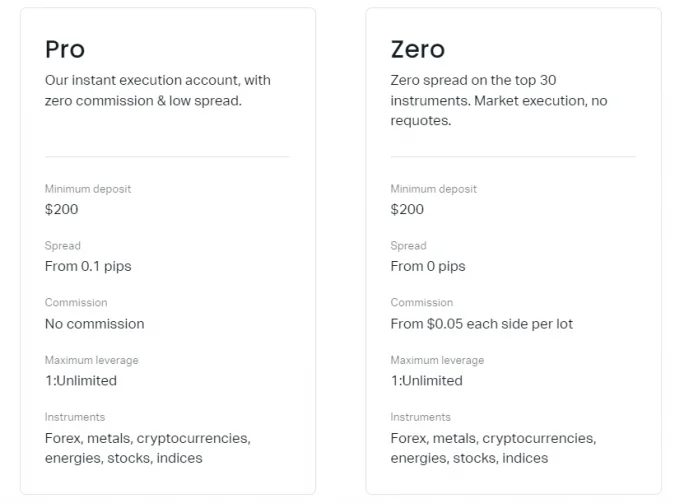

Pro Accounts usually feature variable spreads starting from around 0.1 pips with no added commission. This model is straightforward and allows for better predictability over total trading costs, especially for those who place longer-term trades.

Zero Spread Accounts eliminate the spread for a wide selection of instruments, offering raw market pricing with a fixed commission per lot. This structure appeals to scalpers and high-frequency traders who require tight entry points and low latency execution.

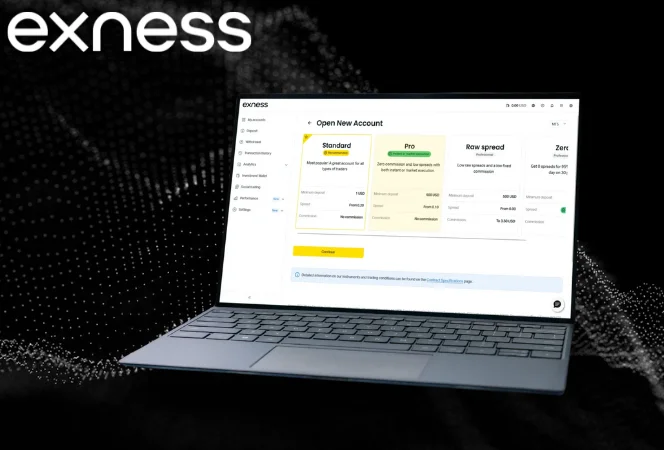

Both account types are offered by major brokers, including Exness, and are available on MetaTrader platforms. The choice depends on trading volume, frequency, strategy, and how sensitive the trader is to costs incurred per order.

Trading Costs and Spreads

Trading cost is one of the key decision-making factors when selecting an account type. Understanding how each model handles pricing and fees can help in optimizing strategy performance.

Pro Account: 0.1+ Pip Spreads, Zero Commission

Pro accounts use a spread-only pricing model. This means traders are not charged an extra commission on each transaction — the broker’s compensation is embedded within the spread.

- Spread: From 0.1 pips on major pairs like EURUSD.

- Commission: None.

- Best for: Medium to high-volume trades, swing trading, and longer holding periods.

While spreads on Pro accounts are floating, they are often stable during normal market conditions. The absence of commission makes it easier to calculate costs and can be advantageous for strategies that rely on precise risk/reward ratios without needing to factor in per-lot commissions.

Zero Account: 0 Spreads on 30+ Instruments + $0.05–0.2 Commission

Zero Spread accounts offer market-exact quotes with no markup on spread — but instead, a fixed commission is charged per trade. This model brings more transparency and is ideal for those who require exact entry and exit points:

- Spread: 0 pips on over 30 key instruments during most of the trading day.

- Commission: From $0.05 to $0.2 per lot per side (varies by instrument).

- Best for: Scalping, EA usage, news trading, and arbitrage strategies.

This account type gives the trader a clear breakdown of costs and is especially effective for strategies where even half a pip matters. However, it is essential to note that 0-pip spreads are not available 100% of the time and may vary based on market liquidity and time of day.

Here’s a simplified comparison:

| Account Type | Spread (EURUSD) | Commission | Total Cost Transparency |

| Pro | From 0.1 pips | $0 | Spread only |

| Zero | 0 pips (often) | $0.05–$0.2 per lot/side | Spread + fixed commission |

Account Features and Tools

While both Pro and Zero Spread accounts are designed for advanced market execution, each offers a different range of tools that align with its structure and target strategies. Understanding these features can help a trader decide which platform is better suited for their operational approach and technical needs.

Tools Available on Pro Accounts

Pro accounts are generally equipped with the full suite of analytical and automated trading features. These accounts are often selected by discretionary and algorithmic traders who need consistent performance, fast execution, and access to deep historical data.

Some notable tools and functionalities available:

- MetaTrader 4 and 5 Compatibility: Pro accounts are accessible on both MT4 and MT5 platforms, offering flexibility depending on trading preference. MT5 users benefit from additional order types and an upgraded interface, while MT4 maintains broader third-party support.

- Unlimited Leverage Options: On certain platforms, the Pro account includes access to customizable leverage, up to 1:Unlimited, under specific conditions. This provides greater flexibility in managing margin and exposure, especially when trading lower-volatility instruments.

- Advanced Charting and Indicators: Traders can access 30+ built-in indicators and 20+ analytical objects. Pro accounts allow customization of these tools, which helps in building detailed setups and trade management plans.

- Expert Advisors (EAs) and Scripts: For traders using algorithmic strategies, Pro accounts support Expert Advisors written in MQL4 or MQL5. This includes the ability to test strategies using historical tick data and implement automated entries based on technical rules.

- Low Latency Execution: Execution speeds are typically within milliseconds, supported by well-distributed server infrastructure. This is important for medium- to high-frequency trading approaches.

- One-Click Trading and Depth of Market (DOM): Features such as one-click trading and live market depth help streamline order placement and allow users to see liquidity levels in real-time.

Unique Features of Zero Spread Accounts

Zero Spread accounts are built to meet the demands of traders who focus on entry accuracy and cost-sensitive environments. These accounts emphasize exact price matching and reduced slippage, which makes them ideal for short-term strategies.

Features typically include:

- Raw Market Pricing: The zero-spread setup provides direct access to real bid and ask prices without markup. This ensures tightest possible entries and exits, especially on instruments like EURUSD, XAUUSD, and major indices.

- Commission-Based Fee Structure: With spreads removed, all trading costs are transparent and fixed. This makes the total trading cost easy to calculate before placing an order — a significant benefit for scalping or high-frequency models.

- Access to Over 30 Core Instruments with Zero Spread: These include major FX pairs, gold, and selected indices. Traders can take advantage of zero spread during high-liquidity periods with no compromise in execution quality.

- Precision Order Management: Since the spread is removed from pricing, traders can place tight stop-loss and take-profit orders without worrying about broker-side price manipulation or spread widening during quiet hours.

- Platform Compatibility and Custom Indicators: Like the Pro account, Zero Spread accounts can be used with MT4 or MT5 and support all standard technical analysis tools. Traders can install and use custom indicators and backtest them against raw price data.

- Support for Algorithmic and News-Based Trading: This account type allows for EAs to function without the noise introduced by variable spreads. Many traders using news-trading robots or latency arbitrage find this structure optimal.

Here is a tool comparison table for clarity:

| Feature | Pro Account | Zero Spread Account |

| Platform Support | MT4, MT5 | MT4, MT5 |

| Spread Model | Floating from 0.1 pips | 0 spread on key instruments |

| Commission | None | $0.05–0.2 per lot/side |

| Suitable for EAs | Yes | Yes |

| One-Click Trading | Yes | Yes |

| Access to Raw Prices | No (includes broker markup) | Yes |

| Execution Speed | Millisecond-grade | Millisecond-grade |

| Depth of Market | Yes (on MT5) | Yes (on MT5) |

Suitability for Different Trading Styles

The decision between a Pro and Zero Spread account isn’t just about costs—it should reflect the trader’s overall strategy, trade duration, frequency, and sensitivity to entry/exit accuracy. Each account model offers unique advantages depending on how trades are planned and executed.

Who Should Choose the Pro Account?

A Pro account fits well with strategies that focus on longer holding times or moderate-frequency setups where predictable costs matter more than ultra-precise execution. Traders using technical analysis, swing setups, or manual discretionary methods may find the Pro account more efficient.

Key characteristics that align with the Pro account:

- Swing Traders: Traders who hold positions for hours or days and prioritize minimal commission costs will benefit from the spread-only model. With no per-lot commission, the total cost over a longer trade horizon remains competitive.

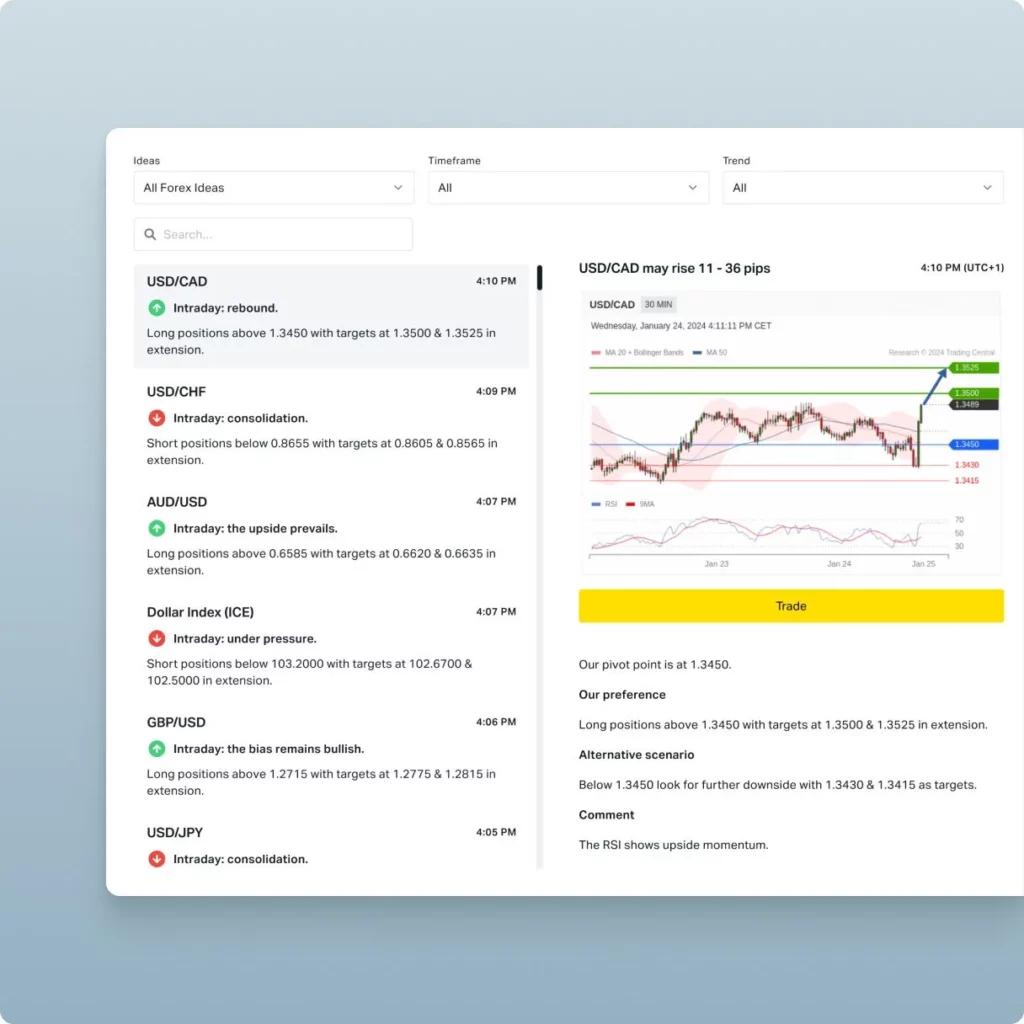

- Manual Traders Using MT4/MT5 Indicators: For those relying on price action, Fibonacci levels, or RSI divergence, the Pro account’s stable spreads and fast execution allow trades to play out with minimal interference.

- Traders Running Lower Volume Strategies: If average trade size is small and volume is modest, avoiding fixed commissions can reduce cost-per-trade overhead.

- System Testers or Discretionary Traders: When backtesting strategies based on average spread behavior rather than raw price ticks, the Pro environment provides realistic results for the majority of general strategies.

- Multi-instrument Traders: Pro accounts offer a wide range of instruments without the complexity of managing spread/commission combinations across each one.

When to Pick the Zero Spread Account?

Zero Spread accounts are engineered for high precision. They are ideal for strategies where the entry price is critical, especially in fast-moving or high-volatility markets. For scalpers, EA operators, and latency-sensitive strategies, raw spreads paired with fixed commissions offer more control.

Strategies suited to the Zero Spread account:

- Scalping and Short-Term Trading: Scalpers aim to capture small price movements, sometimes just a few pips. In this case, eliminating spread costs and working with a predictable commission per lot offers greater accuracy in cost calculations.

- News-Based Traders: News traders who time entries within seconds of macroeconomic releases need exact prices to limit slippage. Zero spread accounts often maintain stable pricing even in the seconds before and after major events.

- Arbitrage and Latency-Based Systems: Certain algorithmic strategies compare price feeds across brokers or networks. Zero Spread accounts give raw pricing, reducing noise and improving accuracy.

- High-Volume or Automated EA Traders: With a consistent commission rate, EAs can calculate breakeven and risk-reward ratios more reliably.

- Traders Running High-Frequency Orders: Traders who open and close multiple trades in short intervals benefit from the fixed, predictable commission structure rather than dealing with the variability of spreads.

Performance and Execution

Beyond costs and features, execution quality plays a decisive role in real-world trading. The ability to open and close orders reliably, with minimal delay or slippage, determines how well a strategy performs over time. Both Pro and Zero Spread accounts deliver high-end execution, but each has its own operational characteristics.

Order Execution in Pro Accounts

Pro accounts are typically configured to offer market execution without requotes. Orders are sent directly to the market and filled at the best available price. Because there’s no commission charged, execution quality focuses more on spread stability and fill reliability.

Key aspects of execution in Pro accounts:

- Low Spread Fluctuation: Even though spreads are floating, Pro accounts are built on premium liquidity channels that keep pricing consistent, particularly during major sessions like London and New York.

- Smooth Order Routing: Orders are processed through high-speed servers that reduce delays. Most trades are executed in milliseconds, which is more than sufficient for medium-term strategies.

- No Slippage Filters by Default: Traders can still experience slippage during fast-moving markets, but in most cases, it’s within an acceptable range — especially when trading highly liquid instruments.

- Fewer Rejected Orders: Because market execution is used, orders aren’t rejected due to pricing mismatches. This is important for strategies that rely on rapid decision-making.

- Partial Fills Rarely Occur: For retail volumes, fills are typically complete unless operating under extreme volatility.

Pro account users often value execution reliability over exact entry price, and for good reason: when you’re holding trades for hours or days, fractions of a pip at entry are less relevant than whether the trade was filled at all.

Execution Speed in Zero Spread Accounts

In a Zero Spread account, execution speed becomes a priority due to the high sensitivity of short-term trading strategies. Since the spread is removed and a fixed commission replaces it, trades rely entirely on being filled at the exact price intended.

Core execution characteristics of Zero Spread accounts:

- Raw Pricing Environment: Zero accounts display unfiltered bid/ask prices pulled directly from liquidity providers. This supports tighter control over entries, which is essential for scalpers.

- Minimal Latency: Execution typically occurs within 10–30 milliseconds, depending on server location and trader’s infrastructure. This is critical for systems executing dozens of trades per day.

- Higher Fill Precision: Because the account offers raw prices, there’s a reduced risk of price discrepancy between what’s shown and what’s filled, assuming stable internet and platform connection.

- Time-Sensitive Order Matching: Traders operating time-critical strategies benefit from consistent matching, which means EAs and scripts perform with higher fidelity.

- Ideal for One-Click and Algorithmic Trading: Tools like one-click trading, combined with fast execution, reduce manual delay. Automated systems can rely on stable order flow without the need to factor in varying spreads.

Frequently Asked Questions

What’s the main difference between a Pro and a Zero Spread account?

The key difference lies in how trading costs are structured. A Pro account includes the broker’s markup in the spread, with no additional commission. A Zero Spread account removes the spread on core instruments but charges a fixed commission per lot traded. The Zero account is optimized for precise entries, while the Pro account is simpler to calculate and manage over time.