- Getting Started with Exness Registration

- Choosing the Right Account Type for UAE Traders

- Basic Requirements for Exness Sign Up

- Step-by-Step Exness Account Opening Process

- Filling Out the Exness Sign Up Form

- Submitting Documents for UAE Residents

- Fast-Track Verification for UAE Traders

- Tips for Quick Exness Registration Approval

- Common Verification Mistakes to Avoid

- Accessing Your Account After Exness Sign Up

- Frequently Asked Questions

Getting Started with Exness Registration

Before opening an account, traders in the UAE should consider about what they want to trade, what tools they want to use, and how much leverage they expect. The UAE Securities and Commodities Authority (SCA) has severe requirements for brokers who work in the country. Exness meets most of these rules and is allowed to do business there. People from the UAE, people living in the UAE with Emirates IDs, and foreigners with valid UAE residence permits can all sign up for Exness. The platform has both Islamic (swap-free) and regular trading accounts, which is quite significant because of the religious issues in the area.

Choosing the Right Account Type for UAE Traders

Exness has numerous sorts of accounts for people with different levels of trading experience and amounts of money to invest. The option relies a lot on how much you trade each day, what kinds of assets you’re interested in, and how you like to trade (scalping, swing, or long-term holding).

| Account Type | Minimum Deposit (USD) | Typical Spread (EUR/USD) | Commission per Lot | Execution Type |

| Standard | 10 | 1.0 pip | None | Market |

| Standard Cent | 1 | 1.5 pip | None | Market |

| Raw Spread | 200 | 0.0 pip | $3.5 per lot per side | Market |

| Zero | 200 | 0.0 pip (on major pairs) | $0 for most instruments | Market |

| Pro | 200 | 0.6 pip | None | Instant / Market |

Key considerations for UAE users:

- Standard and Pro accounts are often preferred by part-time traders with daily activity.

- Islamic account option is available upon request after registration.

- Leverage up to 1:2000 is available, depending on the instrument and regulatory restrictions.

Basic Requirements for Exness Sign Up

To start, traders must meet the following basic requirements:

- As to UAE law, the legal age is 18 years or older.

- To verify, you need a valid mobile number with the UAE code (+971).

- Email address for safe communication and access.

- You need to show proof of your identity, like an Emirates ID, a passport, or a residence permit.

- Proof of residency, which might be a bill from DEWA, a rental contract, or a bank statement with your address on it.

More than 95% of applications that are turned down are because the documents are not formatted correctly or the ID uploads are out of date.

Step-by-Step Exness Account Opening Process

Residents of the UAE can open their account immediately from the official Exness website after they have all the necessary details. You can fill out registration forms on your phone, and you can do all the processes on your phone.

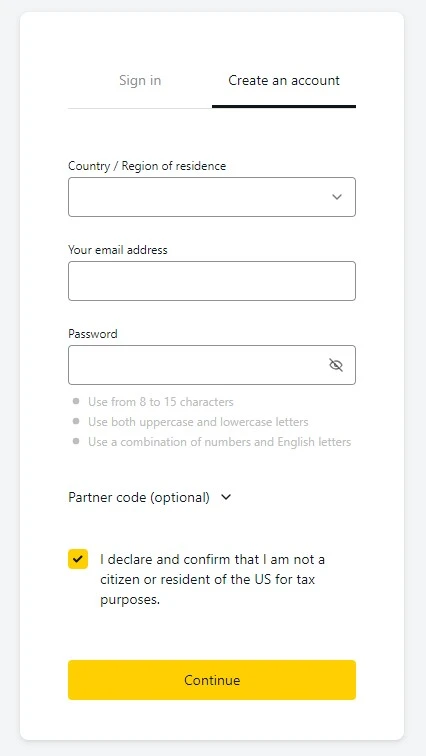

Filling Out the Exness Sign Up Form

The first step is to give your UAE cellphone number and email address. A verification code is issued right away by email and text message, and it is good for 60 seconds. There must be at least 8 characters in a password, and they must be a mix of numbers and Latin letters.

Sign-up Form Sections:

- Email & Phone Number: Required for 2FA setup.

- Personal Details: Full name (as per ID), country of residence, and birth date.

- Account Type Selection: Choose from Standard, Pro, etc.

- Trading Platform: MT4 or MT5.

- Leverage & Currency: Set preferred base currency (AED, USD, etc.).

- Security Questions: Helps protect your login access.

By completing these fields accurately, you reduce the chance of rejection during the next steps.

Submitting Documents for UAE Residents

After filling out the form, you must upload documents that prove your identity and where you live. Exness staff will examine them automatically and, if necessary, revise them. Processing usually takes between 2 and 24 hours, depending on how many applications there are and how good the documents are.

Documents Needed for UAE Clients:

| Document Type | Accepted Formats | Processing Time |

| Emirates ID (front/back) | JPG, PNG, PDF | 1–2 hours |

| Passport (photo page) | JPG, PNG | 1–4 hours |

| Residence Visa | PDF or clear JPG | 4–12 hours |

| Utility Bill/Bank Letter | PDF, not older than 90 days | 12–24 hours |

Files must be under 10MB and all corners of the document should be visible.

Fast-Track Verification for UAE Traders

If account verification takes too long, funding and trading could stop. This is especially dangerous for traders in the UAE who need speedy execution. Exness checks your identity and address using both automated and manual methods. It usually takes less than a day. Some users, on the other hand, indicate that verification may be done in 45 minutes if all the papers are in the appropriate format.

If you want your application to be completed fast, make sure your documents are clear, in the right file format, and have expiration dates.

Tips for Quick Exness Registration Approval

To help UAE residents avoid delays, follow these practical steps:

- If your Emirates ID has a different spelling than your passport, make sure to spell your name the same way on all of your documents.

- It’s best to scan documents flat or with a high-resolution smartphone camera than at an angle or in bad light.

- Before you upload files, make sure that password protection is turned off for PDFs.

- Your proof of residency must include your full name and address and have been issued in the recent 90 days.

- Make sure that JPEGs and PDFs are each less than 10MB to avoid upload problems.

Common Verification Mistakes to Avoid

It’s very vital to review your papers again before you submit them in so that the process runs fast and easily. If you don’t send in the right papers, it could take longer, get turned down, or need further checks, which can be very unpleasant when you’re busy trading. Users may find it easier to register if they know about and fix difficulties such not being able to see all the documents, using the improper file formats, or having information that doesn’t match. Below is a summary of some common mistakes, what they do, and some tips on how to avoid them and speed up the verification process:

| Mistake | Impact | Suggested Fix |

| Cropped or cut-off document edges | Leads to automatic rejection | Re-take photo with full document visible |

| Uploading screenshots instead of scans | May result in unverifiable content | Use original photos or scanned copies |

| Submitting expired passport or visa | Causes manual delay in review | Check document expiry dates carefully |

| Address not matching proof of ID | Verification halted | Submit utility bill or bank letter with same name |

| File size over 10MB | System may fail to process | Compress file without losing clarity |

Avoiding these errors can reduce registration time by up to 70%, especially during high-demand trading days like Mondays or market news releases.

Accessing Your Account After Exness Sign Up

Once verified, users receive full access to all trading features. The Personal Area (browser-based) is where users can manage funds, monitor transaction history, and set trading preferences. The Exness Trader App on iOS and Android supports real-time market tracking, deposits, withdrawals, and account management.

| Method | Platform | Authentication | Common Use |

| Personal Area | Web browser | Email + password + 2FA | Settings, deposits, account control |

| Exness Trader App | Mobile (iOS/Android) | Biometric / PIN / 2FA | On-the-go access |

| MT4 / MT5 Terminals | Desktop & Mobile | Login + trading server | Executing orders, chart analysis |

Frequently Asked Questions

How long does it take to verify Exness in the UAE?

Most users in the UAE are verified in 6 to 24 hours, but if all the documents fit platform standards, some users are approved in less than an hour.