What is Stock CFD Trading on Exness?

Stock CFD trading on Exness refers to speculating on the price movement of publicly traded companies without actually owning their shares. Traders enter buy or sell positions based on whether they expect a company’s stock price to increase or decrease. This is executed through contracts that mirror the price of the actual stock, allowing gains or losses to be realized based on the difference in price between the entry and exit points.

These trades are settled in cash rather than physical shares, making the process more efficient and suitable for short- and medium-term strategies. The trading platform provides access to dozens of U.S. and international stocks, covering various industries including tech, automotive, retail, and more.

By using leverage, Exness clients can control a larger position size than their deposit would allow in a traditional market, making it possible to generate significant exposure with limited capital.

CFDs vs Direct Stock Ownership

Understanding the difference between trading stock CFDs and purchasing actual shares is essential for making informed trading decisions.

| Aspect | Stock CFD Trading | Direct Stock Ownership |

| Ownership | No ownership of the underlying asset | Full ownership of actual shares |

| Leverage | Up to 1:20 (or 1:5 during earnings) | No leverage; full capital required |

| Market Access | Long and short positions | Typically long positions only |

| Settlement | Cash-settled | Requires actual share transfer |

| Dividends | Adjusted via cash adjustment | Received in full by the shareholder |

| Capital Requirement | Lower, due to leverage | Higher, full market value needed |

| Speed of Execution | Instant on trading platforms | Slower via brokers or exchanges |

Stock CFDs are well-suited for active traders focused on short-term market moves. In contrast, buying stocks outright is more common among investors seeking long-term capital growth and dividend income.

Available Companies: Apple, Tesla, Microsoft, Meta, Amazon

Exness offers access to CFDs on a wide range of blue-chip companies. These stocks are selected based on liquidity, volatility, and global demand.

Here are some of the most popular stocks available for CFD trading:

- Apple Inc. (AAPL): A leading name in consumer electronics, Apple’s stock is a staple in tech portfolios.

- Tesla Inc. (TSLA): Known for electric vehicles and innovation, Tesla remains one of the most traded stocks.

- Microsoft Corporation (MSFT): A cornerstone of the global software industry, Microsoft offers consistent market activity.

- Meta Platforms Inc. (META): Formerly Facebook, Meta is central to digital advertising and social media growth.

- Amazon.com Inc. (AMZN): Dominating e-commerce and cloud services, Amazon’s stock is often highly reactive to earnings and macro news.

These equities can be traded under favorable terms and in both directions — opening the door to opportunity whether the stock is rising or falling.

Stock CFD Trading Conditions

Exness provides transparent and consistent trading conditions tailored to CFD stock traders who need precision, control, and timing. The parameters are designed to accommodate retail and professional strategies, including intraday trading and event-based positions.

Fixed 1:20 Leverage (Reduced to 1:5 During Earnings)

Leverage is one of the most powerful tools in CFD trading. On Exness, stock CFDs come with fixed leverage of 1:20, allowing traders to control a position size that is 20 times their margin. This amplifies both gains and losses, so it’s essential to manage risk accordingly.

However, to address the volatility surrounding earnings reports, leverage is automatically reduced to 1:5 three hours before the market opens on earnings day. This reduction remains in place until the market closes after the report is released.

This practice reflects market-wide risk adjustments and ensures that margin exposure remains under control during periods of unpredictable price movement.

Condition

| Condition | Standard Period | Earnings Release Period |

|---|---|---|

| Maximum Leverage | 1:20 | 1:5 |

| Effective Timeframe | Normal trading days | 3 hours pre-market to close |

| Applies to | All stock CFDs | Stocks with earnings events |

Traders should always review the corporate calendar in advance and plan positions around these leverage adjustments.

Trading Hours: 13:40–19:45 GMT (Pre-market Available)

Stock CFDs on Exness follow U.S. stock exchange timings, with trading open from 13:40 to 19:45 GMT, Monday to Friday. These hours align with the U.S. pre-market session, providing early access before official market openings at 14:30 GMT.

The early session gives traders the opportunity to act on overnight news, earnings reports, or macroeconomic data released before the regular session. It’s particularly valuable for strategies focused on gaps, momentum, and short-term volatility.

Session

| Time (GMT) | Description |

|---|---|

| 13:40–14:30 | Pre-market Access: Early access to pricing |

| 14:30–19:45 | Regular Session: Core trading hours |

| 13:40–19:45 | Total Availability: Full access to trading stock CFDs |

No weekend trading is available on stocks, so positions held over Friday are subject to increased gap risk.

Floating Spreads and Overnight Swaps

Exness uses a floating spread model for stock CFDs, where the bid-ask spread adapts to market conditions in real time. This model ensures tighter spreads during normal liquidity periods and allows spreads to widen during low liquidity or high volatility — such as during earnings releases or major news events.

Stock CFD trades also incur overnight swaps, which are interest-based adjustments applied to open positions held beyond the trading day. These are calculated based on the stock’s currency and direction of the trade (long or short).

Key points regarding swaps:

- Long positions may incur charges if the borrowing rate is higher than interest earned.

- Short positions may generate income or incur costs depending on the availability and short interest rate.

- Swap-free options may be available under specific account types or trading conditions.

How to Start Trading Stock CFDs

Getting started with stock CFD trading on Exness is a straightforward process. Traders can open an account, choose a trading platform, and begin analyzing and executing positions on global equities — all within a few steps. Whether accessing via desktop, web, or mobile, the platform setup is optimized for efficient execution and real-time monitoring.

Account Setup

The first step in trading stock CFDs is registering an account through the Exness website. This process requires standard verification steps in line with regulatory requirements, including identity verification and proof of residence.

Once registration is complete, users can choose from several account types. Most stock CFD trading is conducted through Standard or Pro accounts, depending on execution preferences and trading strategy. These accounts differ in terms of spreads, commission structure, and execution model.

| Account Type | Spread Type | Commission | Execution Type | Suitable For |

| Standard | Floating | None | Market | Casual to frequent traders |

| Pro | Low floating | None | Market | Experienced traders |

| Raw Spread | Near-zero | Fixed | Market | Scalping & volume-based |

| Zero | Zero (selected instruments) | Fixed | Market | High-frequency strategies |

There’s no required minimum deposit, but practical access to stock CFDs may depend on the size of the initial funding and leverage applied.

After selecting an account type, traders can fund their account using various supported methods — including local transfers, electronic wallets, bank cards, and cryptocurrencies. Deposits are usually processed instantly, and withdrawals follow a priority system based on previous deposit methods.

Using MT4/MT5 and Exness Terminal

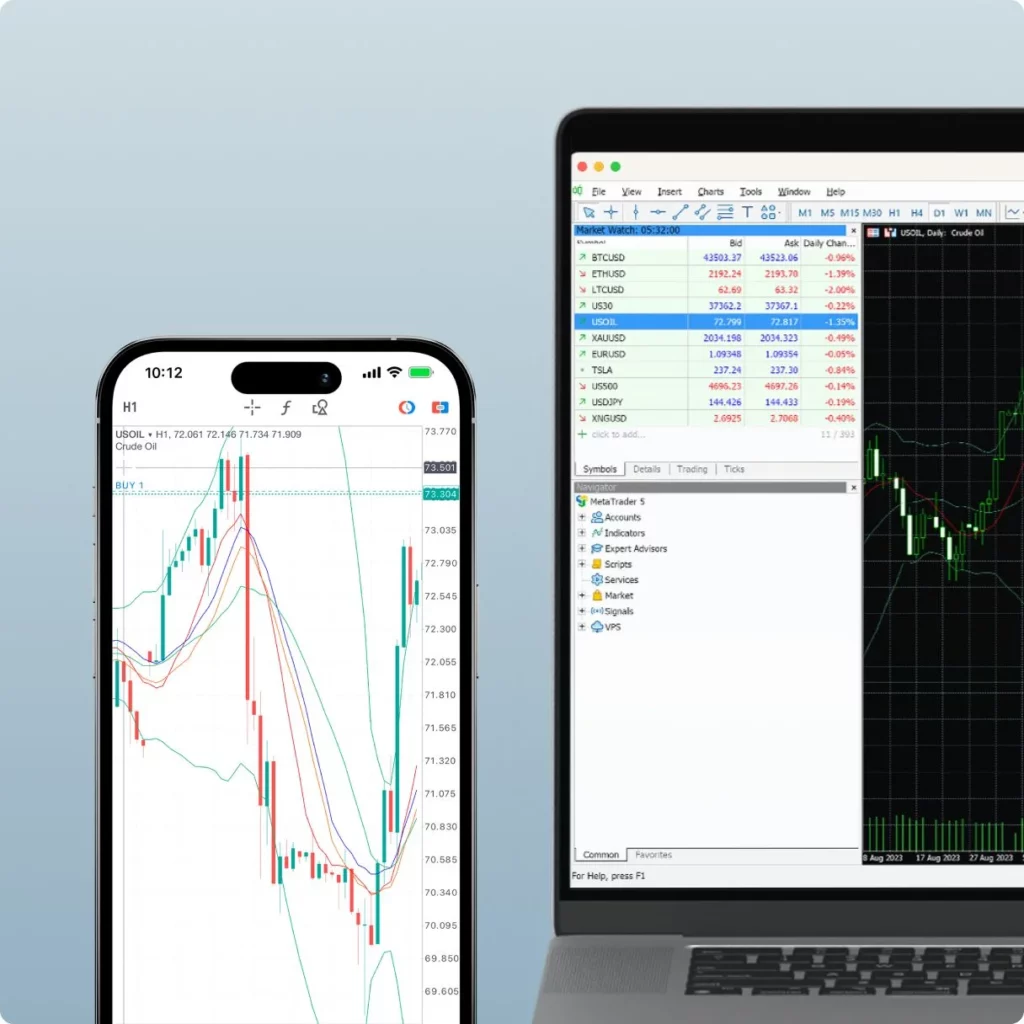

Traders can access stock CFDs through multiple platforms provided by Exness, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the Exness Terminal. Each option supports real-time quotes, advanced order types, and integrated indicators, but there are differences worth noting.

| Platform | Available Stocks | Custom Indicators | Auto Trading | Mobile Version | Multi-Asset Support |

| MT4 | Yes | Yes | Yes | Yes | Limited |

| MT5 | Yes | Yes | Yes | Yes | Full support |

| Exness Terminal | Yes (MT5 only) | Limited | No | Yes (via Exness App) | MT5 accounts only |

MT4 remains a strong choice for traders with existing custom tools, especially Expert Advisors (EAs) or technical indicators tailored to the platform. However, for broader stock selection and multi-asset strategies, MT5 offers enhanced depth of market features and a more modern architecture.

The Exness Terminal, a browser-based trading platform, provides simplified access to MT5 accounts without installing any software. This is suitable for traders who need flexibility or access from multiple devices.

Steps to start trading:

- Log in to the trading platform with your credentials.

- Open the Market Watch to view available stock symbols.

- Add desired instruments like AAPL, TSLA, or AMZN.

- Open a new order and set volume, stop loss, and take profit levels.

- Choose between Buy or Sell based on analysis.

Chart customization, technical analysis, and news feeds are all integrated, allowing users to make decisions based on a complete data set.

Stock CFD Trading Tips

Success in stock CFD trading depends on more than just identifying a rising or falling price. Timing, preparation, and strategy all play crucial roles in building consistency and minimizing risk. Here are several practical tips that can help traders improve decision-making and maintain discipline when trading equities via CFDs

Monitor Earnings Calendars and Corporate Events

Earnings reports often lead to sharp price movements. It’s essential to stay informed of upcoming earnings dates for any stock being traded. Keep in mind that leverage is automatically reduced before these events to manage volatility, and spreads may widen temporarily.

Other company-specific events to track:

- Dividend announcements.

- Mergers or acquisitions.

- Product launches.

- Regulatory investigations.

These can all impact price direction and liquidity, often without much warning.

Use Stop Losses and Take Profit Levels

Risk management is crucial in CFD trading, especially when using leverage. Placing a stop loss order defines the maximum acceptable loss on a trade, while take profit levels can lock in gains automatically.

Tips for setting risk parameters:

- Avoid placing stops too close to the entry price; this can lead to premature exits.

- Adjust stop loss and take profit according to recent support/resistance zones.

- Consider volatility indicators (e.g., ATR) to estimate reasonable price swings.

A trailing stop can also be useful to lock in profits as the market moves favorably.

Trade During Liquid Hours

Stock CFDs are available from 13:40 to 19:45 GMT, but not all times carry equal trading quality. The highest liquidity — and often the tightest spreads — occurs around the opening of the U.S. regular session at 14:30 GMT.

Avoid placing trades during the final minutes of the session unless the strategy specifically targets closing gaps or price reversion patterns.

Analyze Price Trends, Not Just News

News events may trigger immediate price changes, but the trend that follows is often more important. Using technical analysis to confirm market direction can improve entry timing and position sizing.

Useful tools include:

- Moving averages (20, 50, 200 periods)

- RSI or MACD for momentum tracking

- Volume indicators to confirm breakout strength

Combining fundamentals and technicals often leads to better results than relying on either approach alone.

Avoid Overleveraging

Leverage increases exposure, but it can also deplete an account quickly if misused. Even though the platform offers fixed leverage up to 1:20, it’s not mandatory to use the full capacity.

Instead:

- Calculate how much capital to risk per trade.

- Use a position size calculator to align leverage with your risk tolerance.

- Consider smaller trade sizes when trading around earnings or news events.

Overexposure to a single stock or sector can increase risk — consider diversifying positions across industries.

FAQ

What are stock CFDs?

Stock CFDs (Contracts for Difference) are financial instruments that allow traders to speculate on the price movement of publicly listed shares without owning the underlying stock. Instead of taking ownership, traders open buy or sell positions based on their expectations of price movement.