Overview of Terms of Use

The Terms of Use serve as the legal framework between the user and Exness. They outline how services are provided and what conditions apply to trading accounts, platform access, and financial transactions. These terms apply to all users, regardless of account type or region, and cover areas like client verification, trading activity, and dispute resolution.

Every client is expected to read and understand the full document before opening an account. While the exact language of the agreement is formal, the essential takeaway is simple: follow the operational rules, trade within accepted limits, and manage your account responsibly.

The agreement also references regulatory compliance. Exness operates under multiple licenses, including those issued by the Seychelles Financial Services Authority (FSA), the Cyprus Securities and Exchange Commission (CySEC), and others. Depending on your location, certain services may be limited or subject to additional terms.

Account Responsibilities

When registering with Exness, clients enter into a binding agreement that places certain obligations on them. These responsibilities start with the account setup and continue through all interactions with the platform.

Rules for Account Creation

Creating an account requires accurate, up-to-date information. This includes a valid name, address, and contact details. Clients are also required to verify their identity by submitting official documents. This verification step is not optional. It’s a legal requirement under anti-money laundering regulations and helps protect the integrity of the trading environment.

Each client must:

- Use their own name and financial details.

- Ensure their account is not used by third parties.

- Keep login credentials private.

- Maintain updated contact information.

False registration or the use of someone else’s identity may result in account termination.

Trader Obligations and Conduct

Once the account is active, users must operate within acceptable trading behavior. This means respecting platform rules and not engaging in activity that could disrupt trading operations or harm other users.

Key obligations include:

- Monitoring account balances and maintaining sufficient margin.

- Avoiding unauthorized automation tools that interfere with execution systems.

- Not abusing system vulnerabilities, latency, or technical gaps.

- Following fair trading practices.

Violations may lead to warnings, account restrictions, or permanent bans. The terms are clear that any attempt to exploit the system—whether through fraudulent activity, unauthorized access, or manipulation of orders—is prohibited.

Trading Rules and Restrictions

Once an account is set up and verified, trading begins. At this stage, users must understand the guidelines surrounding trading activity. These are not just technical limitations—they reflect the company’s risk controls and market standards. Exness outlines clear practices that are allowed, and others that are strictly restricted. Failure to observe these can lead to trade cancellations or account suspension.

Allowed Trading Practices

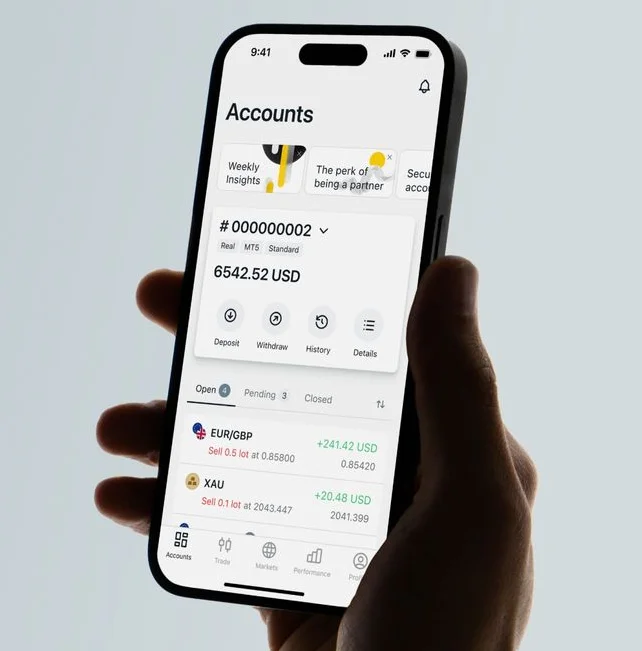

Exness permits a wide range of strategies and tools, offering flexibility to both manual and automated traders. The platform supports high-frequency trading, algorithmic systems, and Expert Advisors (EAs) on MetaTrader 4 and 5. These functions are especially relevant for traders who rely on fast execution and strategy customization.

Accepted practices include:

- Opening and closing positions manually or through automation.

- Using pending orders (Buy Stop, Sell Stop, Buy Limit, Sell Limit).

- Hedging positions (holding opposite trades on the same instrument).

- Scalping and intraday trading.

- Applying stop loss and take profit levels for risk management.

These features are made possible through Exness’ infrastructure, which supports ultra-fast execution, floating spreads, and access to a wide selection of instruments, including forex pairs, indices, metals, energies, stocks, and cryptocurrencies.

Prohibited Activities

Not all strategies are allowed. Some trading behaviors present risks to market integrity or put the platform at operational risk. To maintain fair conditions, certain activities are explicitly banned.

Prohibited actions include:

- Abusing price latency or server delays to profit from arbitrage.

- Coordinating trades between multiple accounts to manipulate outcomes.

- Opening positions with the intent to exploit bonus or credit mechanics.

- Using third-party scripts or bots that interfere with platform stability.

- Falsifying trade history or submitting misleading data during support investigations.

Additionally, accounts showing signs of activity with no legitimate trading intent—such as repeated small trades aimed at generating affiliate commission or exploiting pricing glitches—may be flagged for review.

Violating these rules can result in corrective action, including removal of profits obtained through manipulation, reversal of trades, and permanent account deactivation. Exness reserves the right to act without prior notice if any activity is deemed harmful or deceptive.

Financial Transactions

Financial transactions are a core function of any trading platform. Exness outlines clear conditions for how deposits, withdrawals, and fund transfers are handled. These rules are in place to ensure operational transparency, prevent misuse, and comply with international financial regulations.

Deposits and Withdrawals

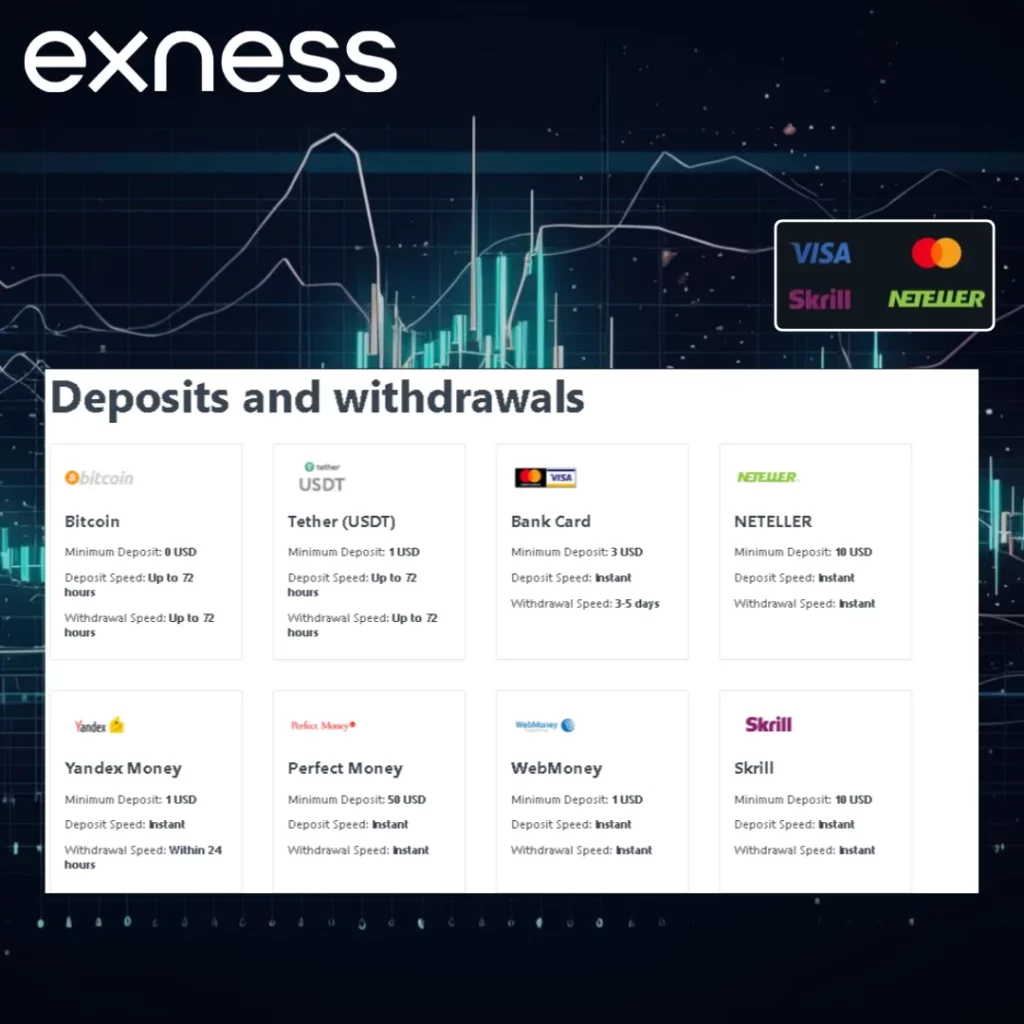

All deposits must originate from accounts that match the trader’s personal information. This rule ensures compliance with anti-money laundering laws and prevents unauthorized access or third-party funding. Deposits can be made using various methods, including bank cards, electronic wallets, local payment providers, and cryptocurrency. The range of available payment systems depends on the client’s region and regulatory environment.

Key principles to follow:

- Deposits and withdrawals must be processed through the same payment system, in the same currency, and in proportion to the original transaction values.

- Exness generally absorbs the transaction fees for most supported methods, meaning traders usually do not incur additional charges for deposits or withdrawals.

- Instant withdrawals are available in most cases, processed automatically in seconds, including on weekends. Exceptions apply in cases of high volumes, verification issues, or technical delays.

There’s also a structured order to withdrawals. Refunds to bank cards or Bitcoin wallets take precedence. After that, profits can be withdrawn according to the order of initial deposits. These rules are enforced automatically and cannot be bypassed.

To reduce the chance of blocked transactions, clients should:

- Avoid funding accounts using payment systems belonging to someone else

- Maintain consistent withdrawal behavior

- Complete all identity and payment verification requirements

Inactivity or suspicious behavior may result in limitations being placed on the account. Repeated attempts to circumvent the withdrawal structure could lead to restrictions or investigations by the compliance team.

Dispute Resolution and Compliance

Disagreements in trading can arise from a number of causes—technical errors, execution discrepancies, or miscommunication. The Terms of Use provide a structured process to address these situations, aiming for clear resolution within defined boundaries. While not all outcomes will favor the client, the existence of a formal procedure ensures that all issues are treated seriously.

Clients who encounter problems with their trading account, order execution, or financial transactions are advised to raise the matter through official support channels. This includes live chat, email, or the personal area within the platform. Most issues are resolved within a few business days, depending on complexity.

Steps in the dispute process:

- Initial contact with customer support: Clients must provide specific details about the issue, including order numbers, timestamps, and screenshots if possible.

- Escalation to the compliance team: If the resolution provided by support is unsatisfactory, a formal complaint may be submitted. The compliance department will then perform an independent review of all relevant data.

- Final decision: Once the review is complete, a response is issued. If the trader remains dissatisfied, they may escalate the matter to external bodies, such as the Financial Commission or relevant regulators depending on jurisdiction.