Overview of Trading Fees

Trading fees on Exness are mainly built around spreads and commissions, depending on the account type. Spreads act as the broker’s markup on buy/sell prices, while commissions are added separately on some accounts with tighter spreads. The broker does not charge inactivity fees, deposit or withdrawal fees, or any recurring monthly charges—making it suitable for both frequent and occasional traders.

For UAE traders, Exness pricing aligns with regional expectations of fairness and cost-efficiency, supporting strategies from intraday to swing trading.

Key points:

- Primary fee: Spread (measured in pips).

- Additional fee (if applicable): Commission (per lot per side).

- Exemptions: No fees for inactivity, deposits, or withdrawals.

- Swap-free options: Available on major instruments for Islamic trading compliance.

Main Trading Costs on Exness

When trading with Exness, the two main cost categories are spreads and commissions. These are determined by the type of account selected and the instruments being traded.

Spreads (Primary Fee Structure)

The spread is the difference between the bid and ask price of an instrument. On Exness, spreads are variable and depend on market conditions, but generally remain tight—especially on major forex pairs like EUR/USD or GBP/USD.

Typical spreads for UAE traders:

| Instrument | Account Type | Average Spread (pips) |

| EUR/USD | Standard | 1.0 |

| EUR/USD | Pro | 0.6 |

| EUR/USD | Raw Spread | 0.1 |

| EUR/USD | Zero | 0.0 |

These spreads make a difference, especially in high-volume trading. On accounts like Zero or Raw Spread, traders pay significantly lower spreads in exchange for fixed commissions.

When Commissions Apply: Zero and Raw Spread Accounts Only

Commission charges apply only on Raw Spread and Zero accounts. These commissions are calculated per lot and per side (open and close positions).

Typical commission structure:

| Account | Commission Per Side | Round-Turn (Open + Close) |

| Raw Spread | $3.5 per lot | $7.00 |

| Zero | From $3.5 per lot | Varies by instrument |

These fees are especially relevant for scalpers or those using Expert Advisors, where execution cost per trade matters more than the spread.

Account Types and Fee Structures

Exness offers multiple account types, each with its own pricing model. UAE traders can choose between accounts that include spreads only or a combination of low spreads and fixed commissions. This flexibility allows traders to align cost structures with their trading frequency, strategy, and risk profile.

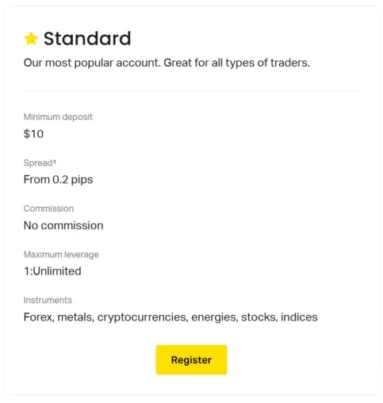

Standard Account: Spread-Only (1.0 pip EUR/USD)

The Standard account is a good starting point for most traders, particularly those looking for simplicity. There are no commission charges. Instead, trading costs are included in the spread.

Key details:

- Spread (EUR/USD): ~1.0 pip.

- Commission: None.

- Execution: Market.

- Minimum deposit: No set minimum (depends on payment method).

This account is popular among discretionary traders who prioritize ease of use and want to avoid managing commission calculations.

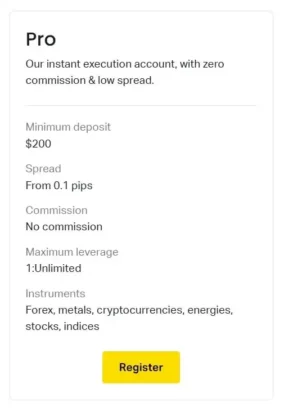

Pro Account: Low Spreads, No Commission (0.6 pip EUR/USD)

The Pro account is designed for active traders who require tighter spreads but want to avoid commission-based pricing. It combines near-institutional pricing with no extra trading fees.

Key details:

- Spread (EUR/USD): ~0.6 pip.

- Commission: None.

- Execution: Market.

- Minimum deposit: May vary depending on payment method.

Suitable for swing traders and high-volume traders who want to keep costs predictable.

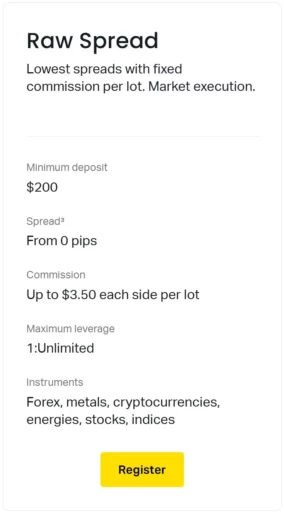

Raw Spread: Ultra-Low Spreads + $3.5–7 Commission

Raw Spread accounts offer extremely tight spreads—starting from 0.0 to 0.3 pips—paired with a fixed commission per trade. This structure is ideal for scalpers or algorithmic traders who value precision in entry and exit points.

Key details:

- Spread (EUR/USD): ~0.1 pip.

- Commission: $3.5 per side per lot (total $7 round-turn).

- Execution: Market.

- Minimum deposit: Depends on method.

Spreads are often near-zero during peak liquidity, helping traders reduce slippage on high-frequency orders.

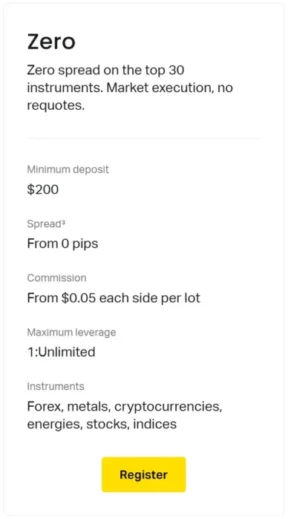

Zero Account: 0 Spreads on 30+ Instruments + Commission

This account type is tailored for those who want guaranteed 0-pip spreads on popular instruments. Commissions vary by instrument but start at $3.5 per side per lot.

Key details:

- Spread (EUR/USD): 0.0 pip (guaranteed on selected assets).

- Commission: Variable; from $3.5 per side.

- Execution: Market.

- Minimum deposit: Based on payment method.

Zero accounts provide transparency and consistency for those trading major pairs or metals frequently.

Additional Costs and What Exness Covers

While spreads and commissions are the primary charges, there are other potential costs in trading. Exness minimizes or fully absorbs several of these, especially for clients in the UAE.

Swap Fees: Swap-Free on Major Pairs, Gold, Crypto

Swap fees are typically charged for holding positions overnight. However, Exness offers swap-free conditions on many major forex pairs, gold instruments, and cryptocurrencies.

| Instrument Category | Swap-Free Option Available |

| Major Forex Pairs | Yes |

| Gold (XAU) | Yes |

| Cryptocurrencies | Yes |

| Minor/Exotic Pairs | Depends on instrument |

| Indices/Energies | Subject to swap charges |

For UAE traders seeking Sharia-compliant trading, swap-free options are automatically enabled based on region and account settings.

No Deposit/Withdrawal Fees: Exness Pays Third-Party Costs

Exness absorbs all internal deposit and withdrawal processing costs. Whether using local bank transfers, e-wallets, or cryptocurrencies, traders are not charged additional transaction fees by the broker.

Key details:

- Deposit fees: None.

- Withdrawal fees: None.

- Processing time: Often instant (automated system).

- Methods: Bank cards, crypto wallets, local payment solutions.

This makes capital movement more efficient, especially in regions like the UAE where speed and transparency are expected.

No Inactivity or Monthly Maintenance Fees

Exness does not charge dormant account fees or any ongoing account maintenance costs. Traders who step away from the markets temporarily won’t face deductions due to inactivity.

This is especially useful for part-time traders or those waiting for specific market conditions.

Cost Optimization for UAE Traders

Understanding fee structures is only one part of the equation. The next step is applying this knowledge to reduce costs and improve net trading results. Exness offers flexible account setups and built-in tools that make it easier to optimize trading efficiency—especially for those based in the UAE where trading habits and instrument preferences vary widely.

Choosing the Right Account for Your Strategy

Selecting an account type that matches your trading approach can make a noticeable difference in long-term costs. Here’s a breakdown of which accounts may be more suitable depending on your style:

| Trading Style | Recommended Account | Why? |

| Scalping | Raw Spread or Zero | Tight spreads with fixed commissions support high-frequency entry/exit. |

| Swing trading | Pro | Low spread without commission; good for medium-term positions. |

| Short-term trading | Standard or Pro | Simple spread-only pricing; easier cost tracking. |

| Algorithmic/EA | Raw Spread | Predictable low-cost structure with fast execution. |

| Islamic trading | Any (swap-free available) | Swap-free setup automatically applied based on region. |

Traders in the UAE often favor major pairs, gold, and cryptocurrencies. These instruments are cost-efficient on all account types, but particularly so on Pro and Zero accounts.

Using the Exness Calculator for Fee Planning

Exness offers a calculator tool that helps traders simulate costs before executing trades. This is especially useful when:

- Planning trade sizes based on available margin.

- Calculating potential swap charges (where applicable).

- Comparing spreads and commissions across account types.

- Assessing trade costs in AED by applying live conversion rates.

This calculator is accessible from the Personal Area and is updated in real-time based on market conditions and instrument specifications.

Key metrics the tool provides:

- Spread cost (in pips and currency).

- Commission per order.

- Swap long/short values.

- Margin requirement.

- Pip value per lot.

For UAE-based traders who often manage positions in AED or USD, the calculator ensures complete visibility into trade impact before execution.

FAQ

Does Exness charge commissions on all accounts?

No. Commissions are charged only on Raw Spread and Zero accounts. Other account types, such as Standard and Pro, include trading fees in the spread.