What Are Trading Signals?

Trading signals are indicators or alerts that suggest potential entry and exit points in the market. These signals are derived from technical analysis, fundamental analysis, or algorithmic computations and are designed to guide traders in making informed decisions.

Signals can take many forms:

- Buy/Sell Recommendations – Highlight optimal times to open or close positions.

- Price Levels – Suggest specific price points for stop loss, take profit, or pending orders.

- Market Trends – Provide insights into the likely direction of price movements.

Whether manually generated by experienced analysts or created by sophisticated algorithms, signals are widely used in both short-term and long-term trading strategies.

Trading Signals on Exness

Exness offers a range of trading signals tailored to meet the needs of traders at different experience levels. Integrated within the MetaTrader platforms and supported by partnerships with external providers, these signals can complement a trader’s technical skills and market understanding.

Types of Signals Available

On Exness, traders can access various types of signals:

| Signal Type | Description |

| Technical Signals | Derived from chart patterns, indicators, and price action, often suitable for active traders. |

| Fundamental Signals | Based on economic events, news, and macroeconomic data affecting market sentiment. |

| Automated Signals | Generated by Expert Advisors (EAs) or algorithmic systems to react to real-time market data. |

| Social/Copy Trading | Signals that allow users to replicate trades from experienced traders directly in their accounts. |

This variety enables traders to select signals that align with their preferred style and risk tolerance.

How Signals Are Generated

Exness signals are created using multiple approaches:

- Algorithmic Models: Advanced algorithms analyze historical data and market conditions to identify potential trade setups.

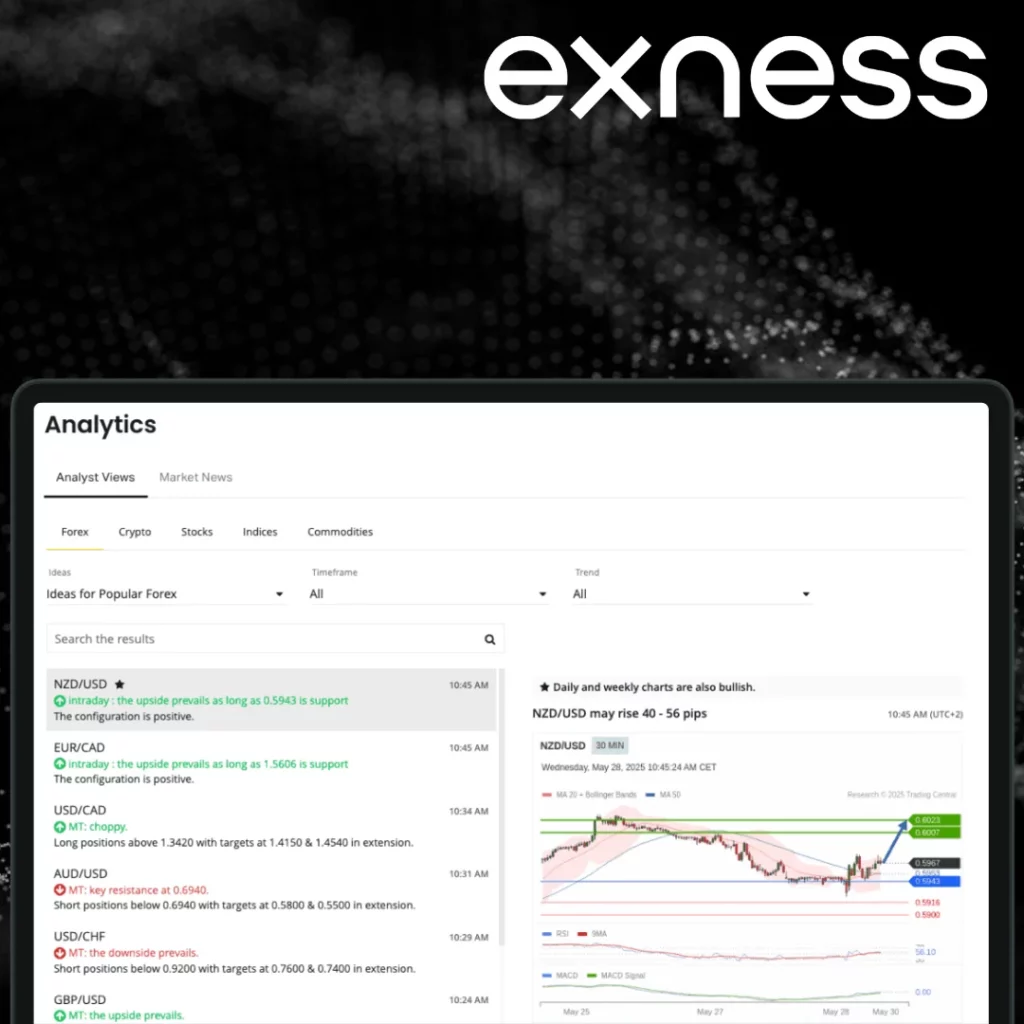

- Technical Indicators: Tools such as Moving Averages, RSI, and MACD form the basis for many signals.

- Expert Traders: In copy trading environments, professional traders provide real-time signals through their trading activity.

These methods ensure that signals are timely and relevant to current market conditions, although traders are encouraged to use them as part of a broader strategy rather than relying on them exclusively.

Where to Find Exness Trading Signals

Exness provides multiple ways for traders to access reliable trading signals directly within its ecosystem and via compatible third-party services. These channels are designed to make signals easily available, whether you trade on a desktop, mobile, or web-based platform.

Accessing Signals on the Platform

Traders using MetaTrader 4 (MT4) or MetaTrader 5 (MT5) can access trading signals within the platforms. The signals feature enables automatic copying of trades from signal providers into your trading account.

Steps to access signals on MT4/MT5:

- Log into your trading account on MetaTrader.

- Open the “Signals” tab in the Terminal window.

- Browse through available providers and view their performance statistics.

- Subscribe to a provider whose strategy aligns with your risk appetite.

- Adjust risk settings before allowing trades to copy automatically.

This integration ensures traders can monitor signal performance and manage subscriptions without leaving the platform.

| Feature | MT4/MT5 Desktop | Exness Terminal | Exness Trader App |

| Signal Subscription | ✔ | ❌ | ❌ |

| Performance Statistics | ✔ | ❌ | ❌ |

| Custom Risk Settings | ✔ | ❌ | ❌ |

| One-Click Trade Copying | ✔ | ❌ | ❌ |

Note: For mobile users, the Exness Trader App offers alerts and notifications, but full signal subscription management is only available on the MetaTrader desktop platform.

External Signal Providers Compatible with Exness

In addition to built-in platform signals, Exness is compatible with well-known third-party providers. Traders often integrate these services to expand their options:

- TradingView – For advanced charting and community-generated trade ideas.

- Autochartist – Delivers technical analysis-based alerts directly to the trader.

- MQL5 Signals – A marketplace within MetaTrader for thousands of professional signal providers.

When choosing external providers, ensure they are reputable and compatible with Exness accounts to avoid integration issues.

Key considerations when selecting external signals:

- Check provider performance over at least six months.

- Understand their risk and reward profile.

- Confirm compatibility with your account type and platform.

How to Use Trading Signals Effectively

Trading signals can simplify decision-making, but their effectiveness depends on how they are applied. Successful traders use signals as part of a broader strategy, rather than relying on them blindly.

Steps to Apply Signals in Trading

Here’s a step-by-step process for using trading signals with precision:

- Subscribe to a Reliable Provider: Choose a signal provider with a proven track record, verified results, and strategies aligned with your trading goals.

- Configure Risk Management Settings: Set your preferred lot sizes, stop-loss, and take-profit levels to match your risk tolerance.

- Monitor Signal Performance: Even after subscribing, regularly assess the provider’s success rate and make adjustments if necessary.

- Test Signals on a Demo Account: Before deploying on a live account, practice with a demo to understand how the signals perform in various market conditions.

- Integrate Signals into Your Trading Plan: Avoid treating signals as standalone instructions; instead, use them to complement your existing strategy.

This structured approach ensures that signals become a helpful tool, not a source of over-reliance.

Combining Signals with Personal Analysis

While signals are designed to assist, combining them with personal market analysis enhances their value.

| Approach | Description |

| Confirming with Technical Analysis | Use indicators like RSI, Moving Averages, or Fibonacci levels to validate signal recommendations. |

| Applying Fundamental Analysis | Check economic news or events that could support or contradict the signal’s direction. |

| Adjusting Based on Timeframes | Align signals with your preferred trading timeframe (scalping, swing trading, etc.). |

| Considering Market Sentiment | Gauge overall sentiment to decide whether to act on or modify the signal’s advice. |

Tip: Successful traders avoid taking every signal at face value. Instead, they view signals as one data point among many and decide based on a combination of factors.

Benefits and Limitations of Trading Signals

Trading signals can enhance a trader’s workflow, but they are not without drawbacks. Knowing their strengths and weaknesses is essential for making informed decisions.

Benefits of Trading Signals:

- Time-Saving: Signals reduce the need for extensive market monitoring by highlighting potential opportunities.

- Access to Expert Insights: Subscribing to reputable providers allows less experienced traders to benefit from seasoned analysis.

- Automation: Many platforms, including MetaTrader, enable automatic trade copying based on signals.

- Versatility: Signals are available for various instruments, from forex pairs to commodities and cryptocurrencies.

- Customizable Risk Settings: Traders can tailor lot sizes and stop levels to align with their individual strategies.

Limitations of Trading Signals:

- No Guarantee of Success: Market conditions are unpredictable, and even the best signals can result in losses.

- Over-Reliance Risk: Relying solely on signals without understanding their logic can hinder skill development.

- Potential for Lag: In volatile markets, delays in receiving or executing signals can impact outcomes.

- Quality Variance: Not all providers maintain consistent performance; due diligence is required.

By understanding these factors, traders can leverage signals effectively while minimizing risks associated with their use.

Frequently Asked Questions

Are Exness trading signals free to use?

Access to trading signals on Exness depends on the provider. Built-in signals available through MetaTrader may require a subscription fee for certain providers, while others offer free signals with limited functionality.