- Exploring the Exness Personal Area Dashboard

- Overview of the Exness Client Area Layout

- Accessing Key Features in My Exness

- Managing Accounts in the Exness Member Area

- Opening and Closing Trading Accounts

- Customizing Account Settings for Better Control

- Handling Deposits and Withdrawals

- Tracking Your Transaction History

- Securing Your Exness Personal Area Login

- Frequently Asked Questions

Exploring the Exness Personal Area Dashboard

The dashboard is the major route for people to get in. It features a clear layout that makes it easier to access crucial trading tools. It has a lot of functions but is still easy to use. When traders log in, they can instantly see how much money is in their accounts, see their most recent transactions, and obtain market news. The design makes it easy to rapidly access crucial information without having to click on a lot of links.

Overview of the Exness Client Area Layout

The client area is set up so that you can quickly see vital information. When users check in, they receive a summary panel that includes their account balance, open positions, and orders that are still waiting. There are four elements to the interface: account management, trading tools, transaction history, and settings. With a customizable widget system, users can choose which parts are most essential to them, such as showing real-time currency pair prices or account equity.

You can easily go to all the key parts by clicking on the icons in the left-hand menu. The statistics area, for example, indicates how well the active accounts are doing, and the trading accounts page shows all of the active accounts. The layout may be used in 24 languages, which is wonderful for the platform’s users from more than 140 countries. This setup makes it easy for traders to find the tools they need, whether they have one account or many.

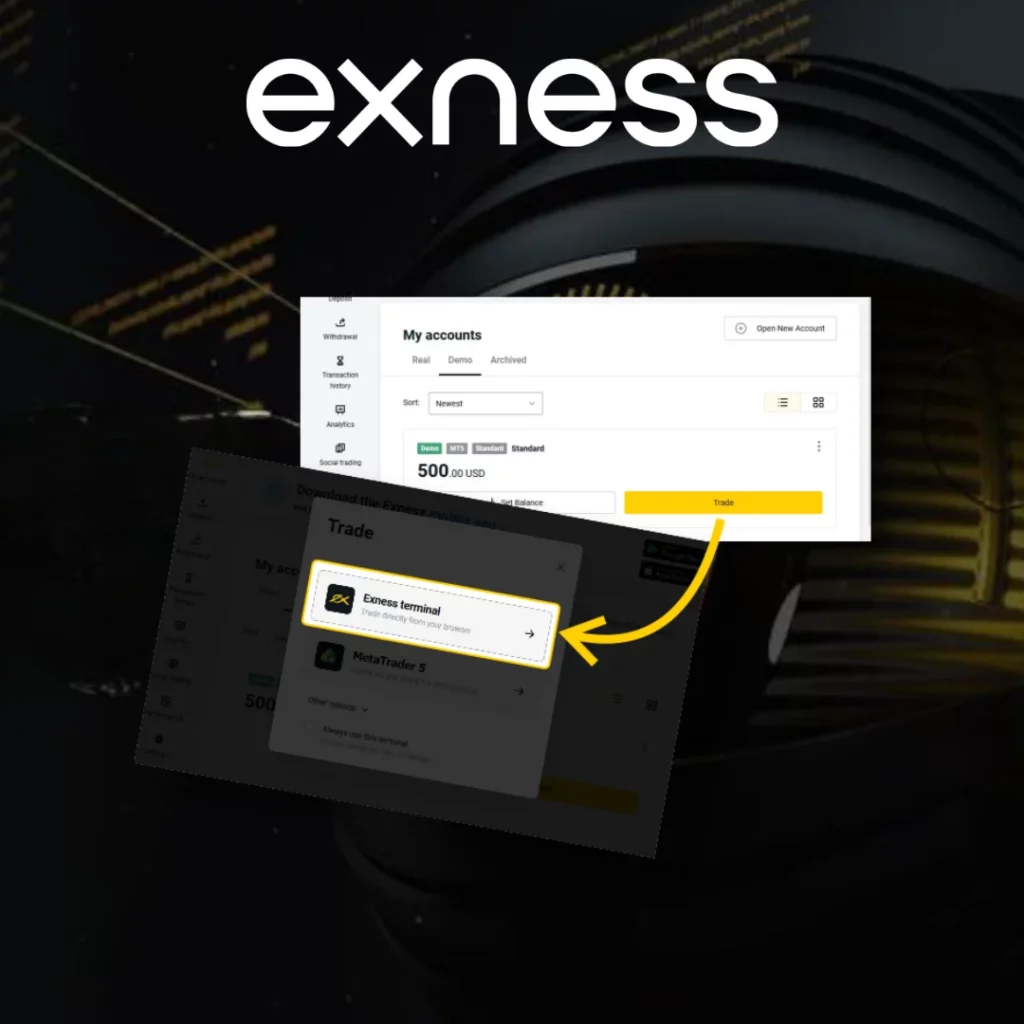

Accessing Key Features in My Exness

The Exness Personal Area provides a variety of useful resources, like real-time market data, account management tools, and direct access to trading platforms like MetaTrader 4 and 5. The analytics tool tells you how successfully you’re trading by showing you things like your profit and loss breakdowns and past trades. These reports are used by 70% of users every week.

The Exness economic calendar helps traders keep track of major financial events. Alerts that let customers know about major market events as they happened, such central bank announcements that effect 60% of their trading decisions, made it better. You can get to customer service in 15 languages, 24 hours a day, seven days a week by clicking a button on the dashboard. These features make it easier for clients to trade by letting them perform numerous kinds of trades fast and efficiently.

Managing Accounts in the Exness Member Area

Account management is a core feature of the Exness Personal Area, enabling users to oversee multiple trading accounts effortlessly. The platform offers various account types, including Standard, Pro, and Raw Spread, each tailored to different trading styles. Over 2 million accounts were opened on the platform. The member area streamlines opening, closing, and adjusting accounts to align with market conditions and personal goals.

Opening and Closing Trading Accounts

According to Exness’s user data, most traders can open a new trading account in under five minutes. From the Personal Area, users select the account type, currency (over 30 options, including USD, EUR, and cryptocurrencies), and leverage settings, which can go up to 1:2000 for some clients. Data shows 65% of new accounts chose leverage above 1:500, highlighting the platform’s flexibility for high-risk strategies. ID verification is required, with 90% of checks completed within 24 hours, enabling quick trading starts.

It’s just as easy to close an account, and you can either save or permanently remove accounts that you don’t need anymore. Traders can close accounts via the account administration area. To make sure people don’t remove them by mistake, there is a confirmation process. By law, Exness must maintain records of transactions for closed accounts for up to seven years. This feature is quite useful for traders who use more than one technique because it enables them clean up their interface without losing any outdated information.

Customizing Account Settings for Better Control

In the Exness Personal Area, traders can customize accounts to suit their needs. Data shows 80% of active traders use tools to manage risk, such as adjusting leverage, setting stop-loss limits, and receiving margin call alerts. The account monitoring feature provides real-time warnings on equity and margin levels, helping avoid liquidation during volatile markets. For instance, 75% of users with tailored notifications avoided margin calls during geopolitical-driven market turbulence.

Traders can link their accounts to more than one platform, however MetaTrader 5 is the most popular, with 60% of clients utilizing it. You can also set up two-factor authentication (2FA) for logins and specify the time zone you want to use for transaction reports. Traders can choose tools that fit their trading style and how much risk they are willing to take, which helps them keep control of their money:

| Account Type | Minimum Deposit | Leverage Options | Spread Type | Popular Among |

| Standard | $10 | Up to 1:2000 | Fixed | 50% of users |

| Pro | $200 | Up to 1:500 | Variable | 30% of users |

| Raw Spread | $500 | Up to 1:200 | Near-zero | 20% of users |

This table summarizes the main account types available, highlighting their accessibility and suitability for different trader profiles.

Handling Deposits and Withdrawals

It’s crucial to monitor your funds while trading, and the Exness Personal Area simplifies deposits and withdrawals. The platform supports over 40 payment methods, including bank cards, e-wallets, and cryptocurrencies, accessible in 140 countries. According to platform data, it processed over 3.2 million transactions, with 95% of deposits instant and 90% of withdrawals completed within a day. This section helps you manage funds efficiently, letting you focus on market opportunities.

In the Personal Area’s funding section, users select their preferred payment method to initiate deposits. Popular options include Visa/Mastercard (45% of transactions), Skrill (20%), and Bitcoin (15%). The minimum deposit is $10 for most account types, but $500 for Raw Spread accounts. Traders can enable automatic deposits to maintain consistent balances, a feature used by 30% of active users. Fees are transparent, with 98% of deposit methods free of extra charges.

You can withdraw money as easily as you deposit it, using the same funding page section. Users must verify their accounts before withdrawing, a process completed in under 24 hours for 90% of users. Withdrawal requests typically take 8 hours, though e-wallets like Neteller offer instant cashouts. Exness provides tools to track withdrawal limits, helping 70% of traders plan large withdrawals during volatile markets by monitoring daily and monthly caps. The platform also supports currency conversion for withdrawals, displaying current exchange rates to avoid unintended losses:

| Payment Method | Deposit Time | Withdrawal Time | Minimum Amount | Fees |

| Visa/Mastercard | Instant | 1-3 days | $10 | None |

| Skrill | Instant | Up to 8 hours | $10 | None |

| Bitcoin | Up to 1 hour | Up to 24 hours | $50 | Variable |

This table compares key payment methods, highlighting their efficiency and cost-effectiveness for traders.

Tracking Your Transaction History

You need to keep an eye on your money to trade effectively, and the Exness Personal Area is a great tool for this. Most customers use it weekly to monitor deposits, withdrawals, and transfers across accounts. The platform keeps track of all transactions and stores the data for up to seven years, as the law says it must. Traders may easily keep track of cash flow and trading performance by sorting transactions by date, account, or type.

The transaction history shows the date, time, amount, and payment method in great detail. Traders can review all deposits and export this data for tax purposes, a feature used by many. For those with multiple portfolios, the platform tracks inter-account transactions, a function popular among active traders. Real-time updates ensure transactions appear within five minutes, keeping users informed in fast-moving markets.

Traders can generate customizable PDF or CSV reports, with some opting for monthly summaries. These numbers reveal how much money was deposited (globally, $1.2 billion) and how much was withdrawn, which might help traders learn how to handle their money. There is also an automated system on the site that discovers 99.9% of unusual transactions. This lets users feel more secure about managing their money.

Securing Your Exness Personal Area Login

Traders want to keep their accounts safe, and the Exness Personal Area has strong security measures in place to do this. Cybersecurity firms say that cyber threats are growing by 20% each year, which is why the platform uses better encryption and authentication methods. Over 1.8 million people have turned on two-factor authentication (2FA), which has made it less than 0.01% of the time that people get into accounts they don’t want to. This section tells you how to keep your login information safe and the trading environment safe.

The login process uses 256-bit SSL encryption to protect data entered during authentication. When traders first log in, they are requested to enable 2FA, which can be set up via SMS or an authenticator app like Google Authenticator. Most users prefer app-based 2FA for its speed. The platform enforces strict password rules, rejecting 30% of initial password attempts for not meeting complexity requirements (at least 12 characters, including numbers and symbols).

Exness makes things safer by letting users see which devices are logged in and which sessions are active. Fifteen percent of users were able to find and end unlawful sessions because to this functionality. Traders can turn on login notifications, and half of them choose to get email or SMS alerts when someone logs in from a device they don’t know. The platform does security audits every three months to meet worldwide standards like PCI DSS. This keeps user data safe from breaches:

- Enable 2FA: Activate two-factor authentication to add an extra layer of security.

- Use Strong Passwords: Create passwords with at least 12 characters, mixing letters, numbers, and symbols.

- Monitor Sessions: Check active logins and terminate unfamiliar sessions immediately.

- Update Regularly: Change passwords every 3 months to minimize risks.

- Enable Alerts: Set up notifications for login attempts to stay informed of account activity.

This list outlines practical steps to secure the Exness Personal Area login, reducing vulnerability to threats.

Frequently Asked Questions

How long does it take to open a new trading account?

As long as they have validated their identification, 90% of users can open an account in less than 5 minutes. It normally takes less than 24 hours to verify.